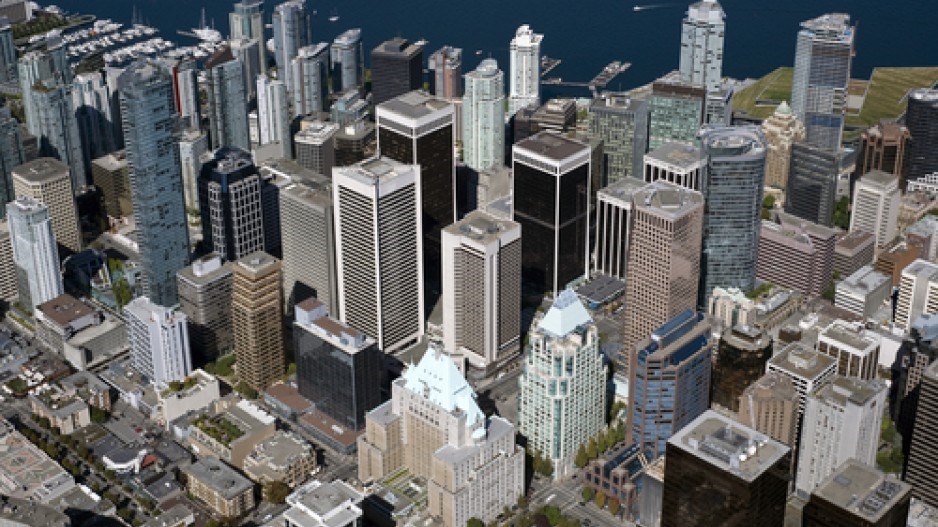

Tenants are taking the driver’s seat in Metro Vancouver’s office sector as vacancy rates hit a nine-year high and lease rates fall, according to a report from Colliers International.

Downtown office lease rates, already softening, could fall another 20% by year-end as new towers draw existing tenants out of older buildings, said

Maury Dubuque, managing director for Colliers Vancouver.

About two million square feet of premium Class AAA space is ascending in seven downtown towers in the biggest office development cycle in two decades.

“There is no problem leasing the new space, but there is a problem leasing the space that is being left behind,” Dubuque said. He expects that existing Class A and Class B buildings will see the largest increases in vacancy, which could potentially lead to notable reductions in leasing rates. The average downtown office lease rate is now $26.68 per square foot, unchanged from a year ago.

The downtown office market has been buoyed by new space taken up by tech giants Microsoft and Sony Pictures Imageworks, which have leased a total of about 210,000 square feet at the refurbished Pacific Centre complex, but the downtown is characterized by “rising vacancy and moderate demand,” Colliers cautions.

So far this year, the downtown has seen negative absorption of more than 100,000 square feet, which means more space is being shoved onto the sublease market than is being leased up. As a result, the downtown office vacancy rate has increased to 5.8%, up from 5.6% in the first quarter, which Dubuque said could be the start of a trend.

While it is typical that vacancy rates increase during a strong development cycle, Dubuque said the current situation is more worrisome.

There are not a lot of large high-tech firms capable of taking large Vancouver office space, he said, and the smaller start-ups active in the sector are more likely seeking smaller, less expensive offices outside of the core, in places like Gastown or Yaletown, he explained.

Also, the service sector, such as law and engineering firms that dominate the downtown market, are consolidating offices and require less space, he said.

Colliers also doesn’t hold out a lot of hope for demand from the resource industry. “In conversations with companies in the LNG [liquefied natural gas] sector, they indicate that they will have only modest office requirements in Vancouver,” Dubuque said.

Across Metro Vancouver, the office vacancy rate is now 11.4%, the highest level since 2005. As Colliers notes, “landlords are putting together increasingly aggressive incentive packages to entice prospective tenants to their buildings.”