It’s not just snowbirds buying up property south of the border.

U.S. real estate bought by Canadians in 2014 more than doubled foreign investment from the next closest country, according to a February 3 report from CBRE Group (NYSE:CBG).

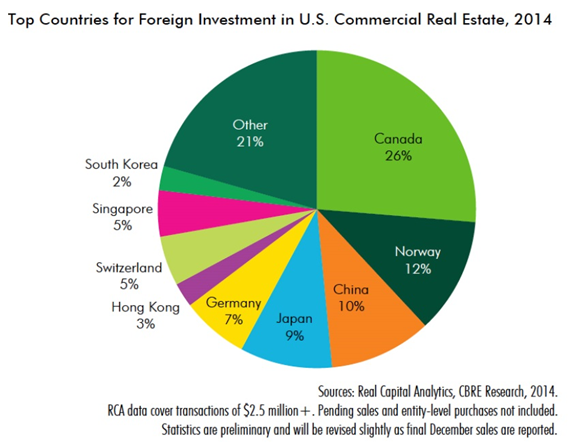

Canadians accounted for about US$10 billion — or 26% — of the US$41 billion in foreign direct investment in U.S. real estate last year.

The next closest country, Norway, accounted for just 12% (US$4.4 billion) of foreign investment.

Canada also managed to outdo investment from China (10% or US$3.8 billion), Japan (9% or US$3.5 billion) and Germany (7% or US$2.9 billion).

In its report, the CBRE described Canada as the “unrivaled global investor” in U.S. real estate.

It noted the level of Canadian investment last year correlated with a healthier U.S. economy and favourable exchange rates.

The Canadian dollar has fallen from about 92 cents U.S. to 78 cents U.S. in the past year as oil prices have fallen sharply.

Manhattan was the main market for Canadians looking to invest in U.S. real estate, accounting for US$3.3 billion.

Boston (US$2.2 billion) came in second and Florida’s Broward County, near Miami, came in third (US$565 million) due to a significant hotel acquisition.

The report noted Seattle’s fourth-place finish ($481 million) was unusual for global capital but “not unusual for Canadian capital given its proximity to Vancouver.”