June is another strong month for B.C. building intentions and aligns with our view that construction, led by residential activity, will be a growth leader for the provincial economy this year.

Municipalities issued permits valued at $1.12 billion during the month, up 16% from May and 35% above the same month in 2014. This was the third time this year that permit volume breached the $1 billion mark. The monthly gain was led by a 75% rebound in non-residential permits after two months of decline, while residential volume held steady from May.

Through 2015’s first half, residential permit volume is up 32% and trending at the strongest pace since the mid-2000s, as low interest rates and modest economic growth drive new home construction and renovation investment.

In contrast, non-residential permits have risen a mild 8%, with businesses still cautious given a weak national economic picture, low commodity prices and slower growth in Asia.

The Lower Mainland’s housing market continued to sizzle in July as near-record sales drove yet another surge in home prices.

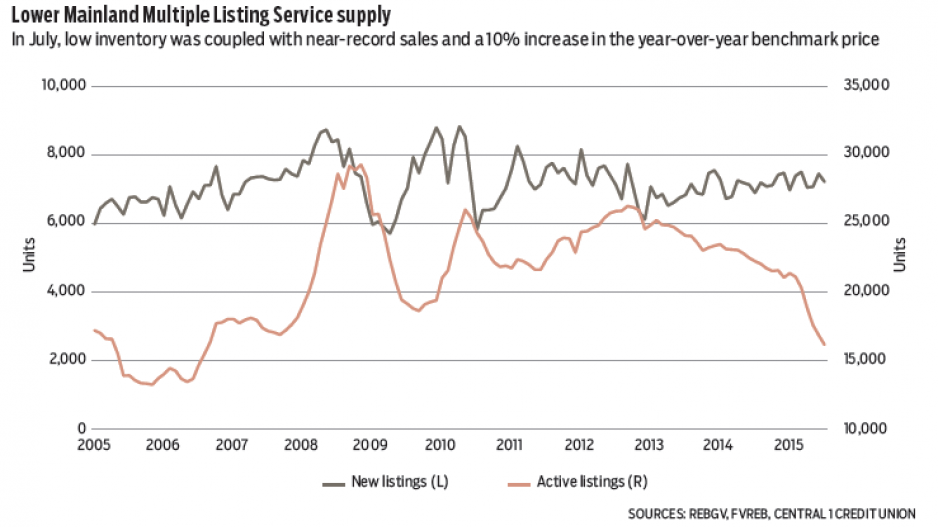

While demand is robust, the region faces a supply-side crisis as home inventories dwindle. With sales eating into inventory, active listings have dropped like a stone since early 2015 to a level unseen since late 2006.

The best proxy available for market tightness is the sales-to-active-listings ratio, which has surged above 30% and is at a level last seen during the heady days of the mid-2000s. This is indicative of a seller’s-to-accelerating market (a balanced market exhibits a sales-to-active-listings ratio of between 15% and 20%).

This mad scramble among buyers for a small inventory is behind surging home-price pressure.

Price trends have accelerated in recent months and on a seasonally adjusted basis have a nearly unbroken streak of monthly price gains since mid-2013. In particular, prices have surged for detached properties, which were up 14% year-over-year, while condo apartments and townhomes climbed about 6%.

Buyers are putting a premium on land ownership, which reflects long-term scarcity in the region, and more options for redevelopment, secondary suites and other income-generating opportunities.

At this point, there is no indication that pricing pressure will cool given low inventory and seemingly robust demand. We expect sales to end the year up 22% to above 59,000 units, which will mark the highest level since 2005, while average annual growth in the benchmark price will be up 9% to $609,500. •

Bryan Yu is senior economist at Central 1 Credit Union.