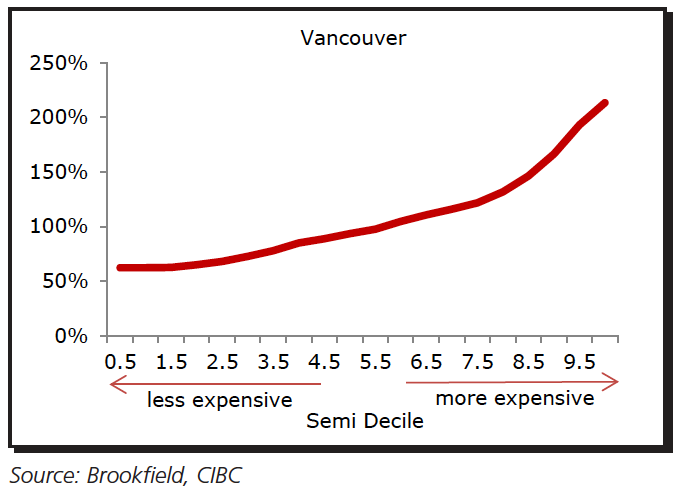

There is a clear divide in Vancouver between price growth for condos and that of detached homes. But according to a CIBC study released September 16, there is a further growing asymmetry even within the detached home category.

Over the past decade, prices of the most expensive homes in the city – those in the top 5% in terms of cost – have increased by more than 200%; in other words, the average price of the most expensive detached homes in the city has more than doubled. But while these expensive homes have become more and more costly, less expensive detached homes – those in the bottom 5% – a have increased in price by a much lower amount – about 60-70%.

According to the study, this asymmetrical price trajectory in Vancouver is the most marked in the country, “with the price gap widening the fastest at the highest end of the market – a fact that might reflect the impact of foreign investment activity in that space.

“This asymmetrical trajectory has major implications for the move-up market and the growth in the renovation market.”

Cumulative Increase in House Prices by House Value (Detached, past decade)—Vancouver

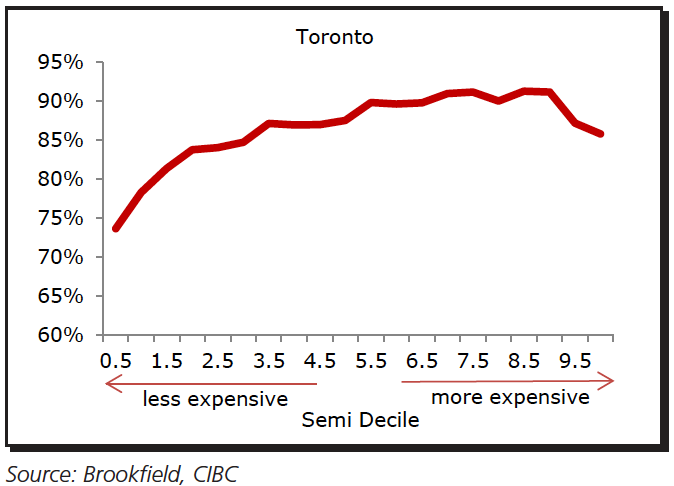

By comparison, in Toronto, there is also a difference between increases in the cost of the most expensive and the least expensive detached homes – but it is far less drastic. Homes in the top 5% have increased just over 85%. The price of the least expensive detached homes, those in the bottom 5%, have increased by closer to 75% – about 10 percentage points lower than for expensive homes.

Cumulative Increase in House Prices by House Value (Detached, past decade)—Toronto

This means the price of the least expensive detached homes in Toronto has increased at a faster rate than those homes in the same category in Vancouver.

Overall across the country, household credit including mortgages is now increasing at the fastest pace in the past three years. Mortgage credit alone accounts for 80% of all Canadian household debt accumulation in the past year, and this is being driven by mortgages in Vancouver and Toronto.

CIBC also noted that recent monetary easing by the Bank of Canada “did little to stimulate borrowing.”

@EmmaHampelBIV