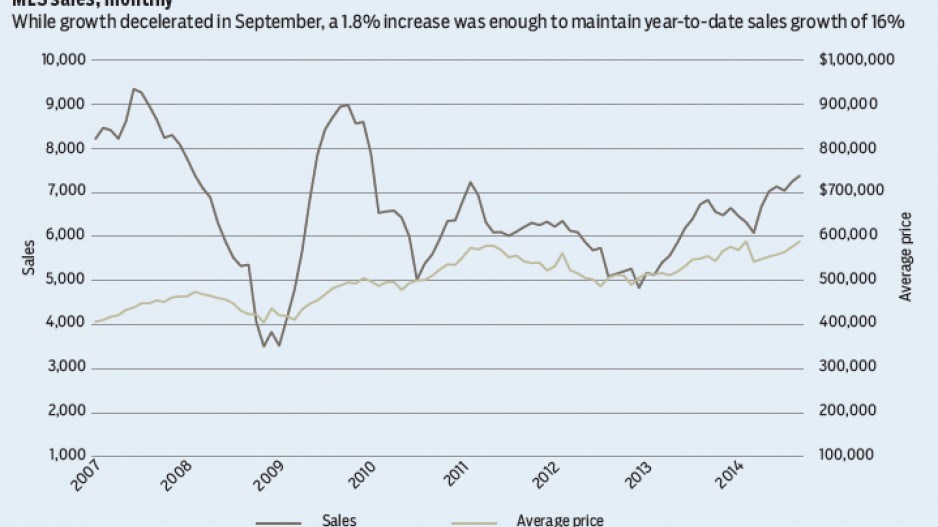

Provincial B.C. Multiple Listing Service (MLS) sales growth decelerated in September, but activity firmed for the sixth time in seven months. Residential transactions climbed 1.8% from August to a seasonally adjusted 7,380 units, up 8% from a year ago and enough to maintain year-to-date sales growth at about 16%. The majority of real estate board areas reported sales growth relative to August, although weaker volumes were reported in Kamloops, Victoria and the Kootenays.

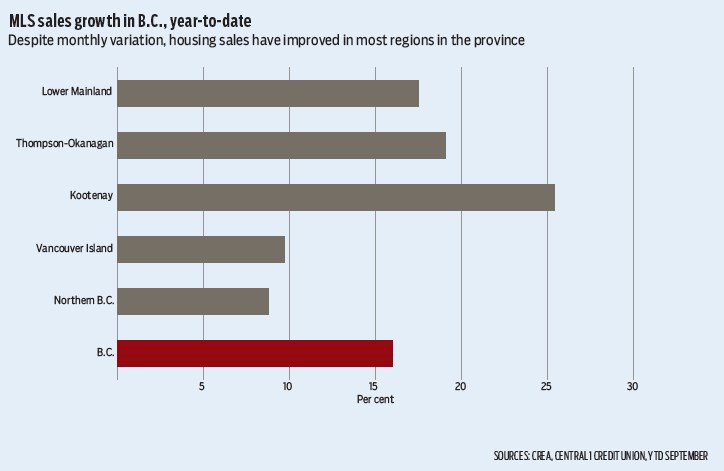

September’s figures point to further momentum in housing demand during the month, despite soft labour market trends for most of the year as low mortgage rates, improvements in recreational housing demand and some pent-up demand likely underpin activity. Despite monthly variation, housing sales have improved in most regions in the province. The focus is often on the Lower Mainland, but year-to-date sales growth has been led by a 20% to 25% sales increase in the central and southern Interior markets, while activity on the Island and in northern markets has climbed by a modest 10%.

That being said, stronger growth in markets in the Okanagan, the Kootenays and Vancouver Island comes after a period of exceptionally weak sales in recent years. In contrast to the Lower Mainland, sales in these markets remain well below mid-decade cycle highs and existing home inventories remain elevated, suggesting continuing supply-demand imbalances and mild price gains.

The provincial average price climbed 2.1% from August to a seasonally adjusted $588,500. Through the first three quarters, the average price is up 6.2%.

Going forward, consumer confidence is expected to be a headwind for October sales given the recent equity market correction and heightened global economic uncertainty. However, subsequently lower bond yields will likely delay mortgage rate increases and trigger short-term cuts, depending on how long the lower funding costs persist.

MLS sales are forecast to rise 10% to 80,000 units this year, while the average annual price gains 5% to $566,000. Sales are forecast to rise a further 5% next year, with the average price increasing by a mild 1%. A stronger economy is expected to offset a gradual upward creep of mortgage rates. •

Bryan Yu is an economist at Central 1 Credit Union.