B.C. building permit volume remained broadly unchanged in October, pointing to persistence of solid construction sector growth. Uplift in residential intentions offset a drop in commercial activity to hold dollar-volume activity at $1.02 billion. Permit volume has hit $1 billion seven times in eight months. Year-to-date, total permit volume is up 15%.

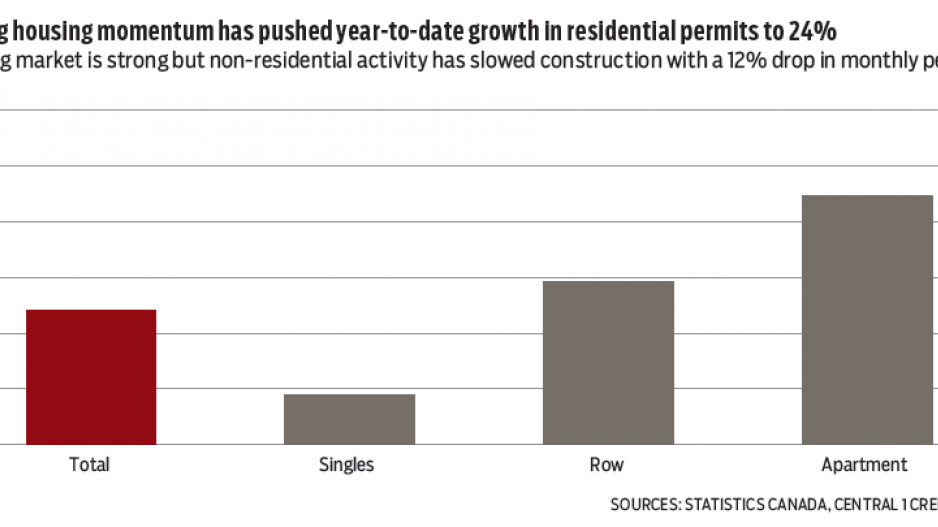

Higher volume reflects strong housing market underpinnings. Residential permit volume, which includes new construction and renovations/upgrades, climbed 5.1% to $753.9 million from September. While below-record highs were observed earlier this year, underlying momentum remains positive and has pushed year-to-date growth to an exceptional 24%, led by a 44% gain in apartment permits.

Similarly, housing starts (of which permits are a leading indicator) have propelled higher, as have property values. According to the Canada Mortgage and Housing Corp., housing starts pulled back in November following October’s uplift, but continued to track above year-ago levels. Year-to-date starts in urban centres were 11% higher than a year ago through November.

About half of total growth reflects a 7.4% gain in the Vancouver census metropolitan area. Relative year-over-year gains are stronger among the Vancouver Island markets and Prince George. Strong demand fundamentals of low mortgage rates and moderate economic growth along with low existing and new-home inventory will maintain residential housing construction at elevated levels into 2016.

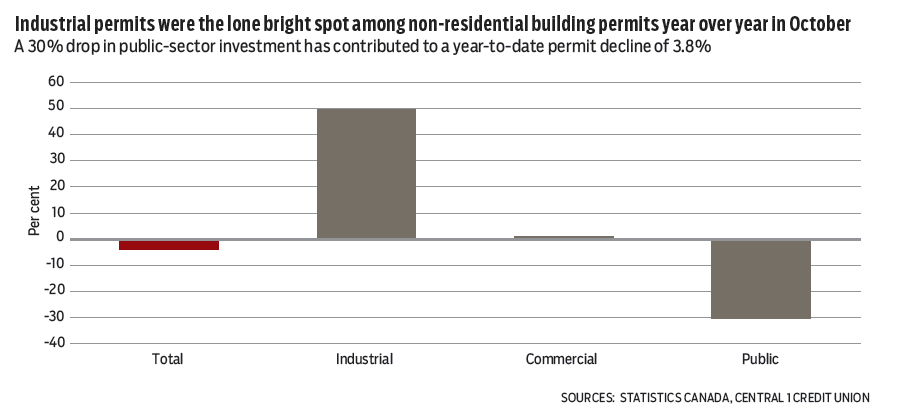

While housing hums, non-residential activity is proving a drag on construction. A pullback in commercial (21% or $42.1 million), drove a 12% drop in monthly non-residential permits to $271.5 million. Slippage in commercial activity and a 30% drop in public-sector investment have contributed to a year-to-date permit decline of 3.8%.

Non-residential investment is being dampened by weakness in energy markets and mining and broad uncertainty in the national and global economy, which will likely persist into mid-to-late 2016. •

Bryan Yu is senior economist at Central 1 Credit Union.