Metro Vancouver's population growth is outpacing new housing starts, according to a new Urban Development Institute (UDI) quarterly State of the Market report.

Since 2011, Metro Vancouver's population has outpaced new housing starts, the State of the Market second-quarter report concludes, and rental vacancy rates remain below 1% for Vancouver proper.

The quarterly analysis compares housing data with other economic indicators, including population growth, immigration, interest rates, global economic trends, commodity prices, stock markets and employment rates.

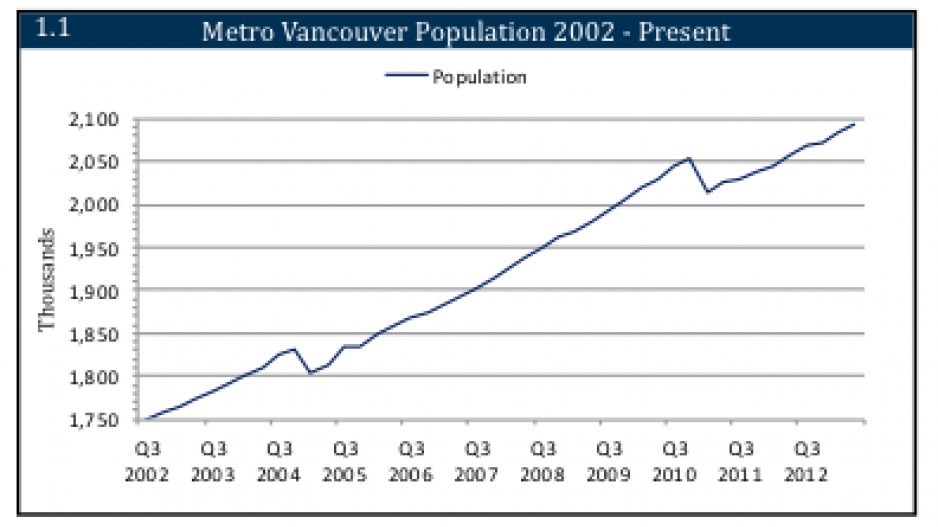

Metro Vancouver's population growth has been growing at about 0.5% per year for the last decade. Metro Vancouver's population has grown to 2.1 million from 1.75 million since 2002.

Since 2011, the region's population growth is attributable entirely to immigration, the report states, as interprovincial migration has been negative over that period. That growth is outpacing new home starts.

Investment in new construction has been increasing since the 2008-09 downturn, although it still lags population growth.

"The most noticeable decline in housing starts is in outer Metro's single family market," the report states. "Since Q1 2010, quarterly volumes have gone from a high of nearly 800 down to just over 300."

Investment in new construction, which took a deep dip in 2008-09, is increasing, however, and is now "approaching levels experienced in 2007."

"The most recently published quarter (Q1 2013) reported a population growth of over three times that of new home starts in Metro Vancouver," the Q2 2013 report concludes. "If this trend persists, anticipate new home sales to remain steady and/or rental vacancy rates to remain low."

As for other key indicators, stock markets are back up, with the Dow Jones Industrial Average now at an all-time high, although the resource-heavy TSX lags, and Bank of Canada five-year conventional mortgage rates remain at near all-time lows (5.14%).

"While representatives from the (Bank of Canada) indicate that they hope to raise interest rates in the near future, it is unlikely this will happen until the U.S. Federal Reserve exits its quantitative easing program," the report said.