Fears of foreign investment in Metro Vancouver real estate driving up home prices are largely baseless, according to the British Columbia Real Estate Association (BCREA), and intervention policies are unnecessary.

The BCREA said in a report released June 10 that foreign investment amounts to less than 5% of the market. However, this number is based on estimates only as “no hard number on foreign buyers in Metro Vancouver housing market exists.”

“In the Metro Vancouver context, data relevant to measuring foreign investment does exist from the 2011 Canadian Census, the Canadian Mortgage and Housing Corporation (CMHC), Urban Futures and REBGV,” the report states.

“While none of these measures are perfectly designed, they were independently produced and converge around a similar central tendency in regard to foreign ownership in the Vancouver housing market.”

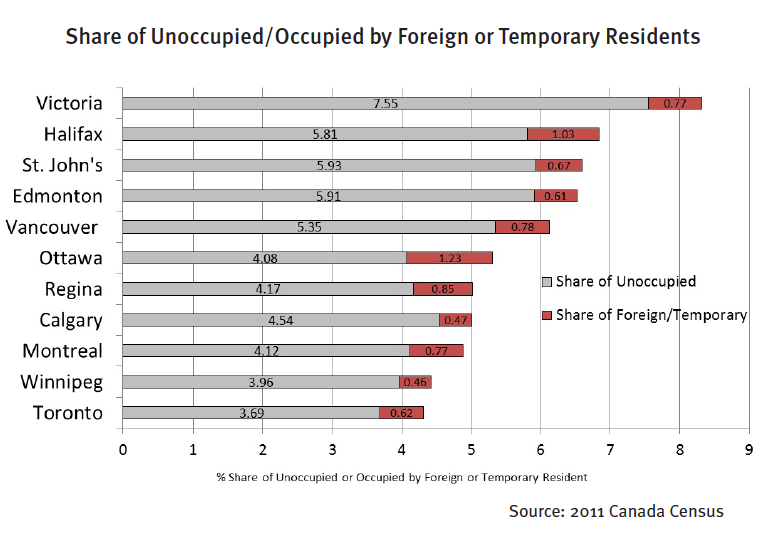

Based on these estimates, the BCREA said the percentage of vacant dwellings in Metro Vancouver is 5.35% and those occupied by foreign or temporary residents is 0.78%. These proportions do not differ significantly from those of other large Canadian cities.

A recent poll by Insights West found that nearly three-quarters – 77% – of Metro Vancouver residents support the idea of a vacant homeowners tax.

Land scarcity is a much bigger determinant of pricing than foreign ownership, the BCREA said.

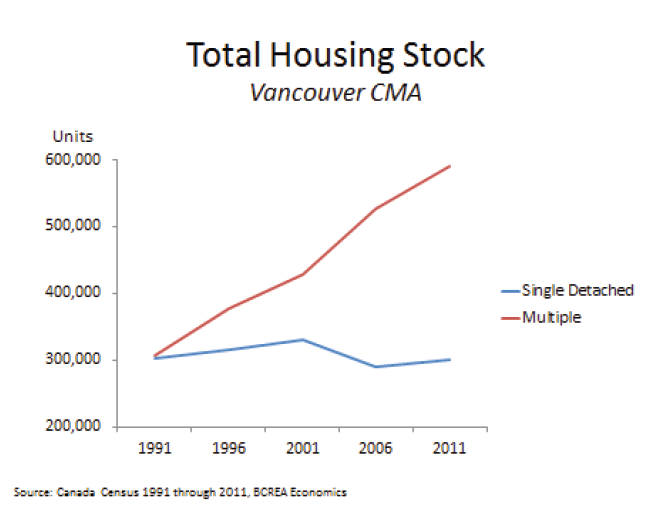

According to the report, “[Vancouver’s] geography is constrained on all sides by natural and legal impediments to the supply of developable land. The vast suburban sprawl associated with many North American cities wasn’t able to fully take root in Vancouver as the relative scarcity of land forced housing stakeholders to look up rather than farther afield.”

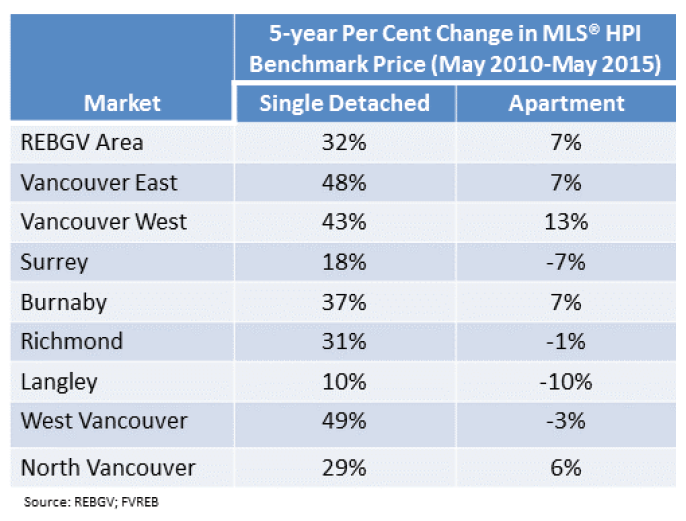

The study also found that the share of single detached homes in the region has dipped from 50% of total housing in 1991 to around a third in 2011. Eighty per cent of new home construction relates to multi-family dwellings. This scarcity of single-detached houses has caused the price of these homes to soar. However, the price of condos has dipped in some Metro Vancouver municipalities, taking into account inflation and wage growth.

The BCREA said using the average home price as a measure of housing affordability is misleading, due to the diversity in the types of homes in Metro Vancouver.

“A more realistic measure would be how many households can afford lower-priced homes.”

According to the association, 70% of all homes sold in the region in 2014 were below the reported average home price of $738,000. Thirty per cent of all home buyers at any given time are first-time buyers, and correspondingly, 32% of homes were below $400,000.

Instead of policies to limit foreign investment, the BCREA said tracking the sources would be beneficial to come up with possible solutions going forward.

“BCREA recommends the government monitor the flow of foreign investment in housing by attaching a residency declaration somewhere in the land transfer form process, or other practical approach,” the report said.

“Gathering data on foreign investment in housing would provide an opportunity to gain further insight into this market segment.”