B.C.'s housing market posted yet another strong performance in May as Multiple Listing Service (MLS) sales climbed for a fourth successive month to maintain sales near pre-recession highs. Residential MLS sales edged higher in May to 8,490 units, up 0.9% from April and 21% from the same month in 2014. Unadjusted for seasonal factors, this was the strongest May performance since 2007.

Year-over-year sales growth was led by the Lower Mainland (24%), Victoria (27%) and the rest of Vancouver Island.

Okanagan sales were up modestly, but sales in the Kootenay and northern markets were down sharply from the same month in 2014. Year-to-date, provincial sales were 22% higher through May.

Despite some regional differences, overarching housing market conditions are positive. Demand is being lifted by the low interest rate, population growth and favourable economic activity. However, sales gains have been slow to induce a supply response, resulting in a rapid decline in existing home inventories. Provincial active listings in May were the lowest since 2009.

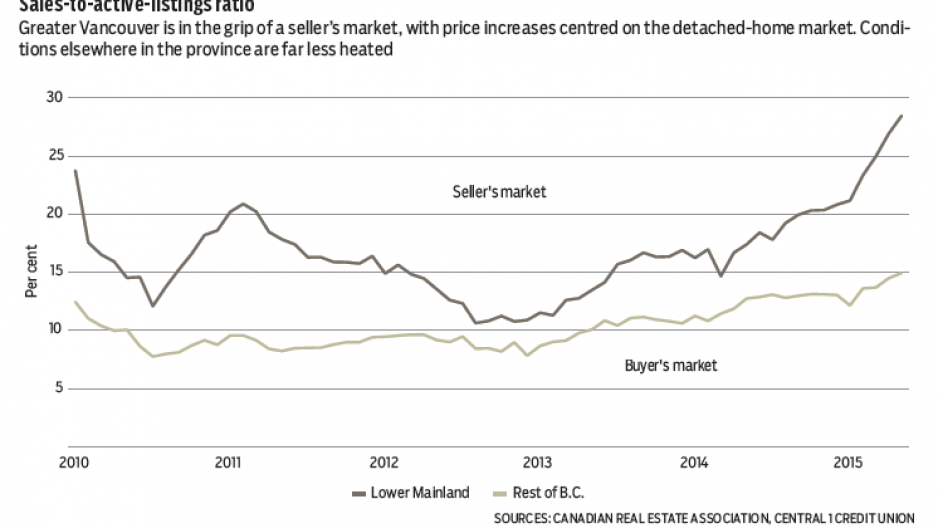

The resulting supply-and-demand dynamics have led to the prevalence of seller’s market conditions in the Lower Mainland and Victoria markets, and balanced markets in the Okanagan Mainline, Vancouver Island (excluding Victoria) and Chilliwack. Pockets of weakness are observed in northern B.C. and the Kootenay owing in part to the influence of weak commodity market activity on local economies.

Generally tight market conditions are lifting prices. The seasonally adjusted average provincial MLS price tracked higher in May to $623,545, adding to a yearlong uptrend. Unadjusted, the average price was up 12% from the same month in 2014, with the year-to-date value up 10%.

Note that average price levels are influenced by product composition, quality and geography, and extremely high-priced homes (particularly in Vancouver). As a result, averages are not always indicative of underlying price pressures.

An alternative constant-quality house price index (HPI) produced by the Canadian Real Estate Association is available for some markets. The HPI shows year-over-year price growth of about 8% in the Lower Mainland and 4% on Vancouver Island (including Victoria). While this is lower than the average metric, the HPI still points to modest-to-moderate price growth. •

Bryan Yu is senior economist at Central 1 Credit Union.

Image: Karamysh/Shutterstock