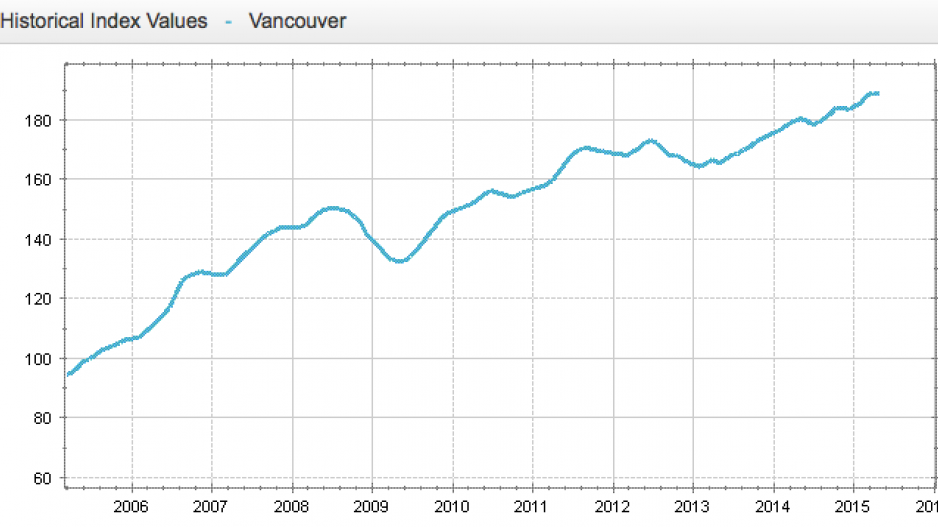

(Graph: Teranet)

Home prices remained relatively flat across Metro Vancouver in April with a modest 0.03% increase being recorded for the month, according to the Teranet-National Bank Composite House Price Index (HPI) released May 13.

The increase, although small, once again brings the home price index for Vancouver to an all-time high.

Canada-wide, the HPI increased 0.2% month-over-month, which was the fourth consecutive monthly gain. According to Teranet, when data from recession-hit 2009 is excluded, this most recent month is tied with 2013 for having the smallest gain in the month of April in the 17 years of index data.

“The slightness of the gain in 2015 came from the component indexes for Vancouver and Toronto [up 0.24% for the month], which were both flat from the month before and which together account for 54% of the composite index,” Teranet said in a release.

The HPI, which uses repeat sales methodology statistics, had its biggest increase in Winnipeg (up 1.9%), followed by Quebec City (1.7%) and Montreal (1.0%).

Home prices in Victoria fell once again, with the month seeing a 0.2% decline.

Year-over-year, prices grew 4.4%, which represents a deceleration from the 4.7% registered in March. Vancouver had the country’s third-highest growth over the period at 4.8%.Hamilton (up 7.6%) saw the country’s biggest increase, followed by Toronto at 7.3%.

Diana Petramala, economist at TD Economics, pointed out that housing prices vary widely across the country and remain a “regional story.”

“Canadian average existing home prices are on track to clock in at 5% to 6% in 2015, largely driven by Toronto and Vancouver,” she said. “In contrast, Calgary home prices are expected to continue to weaken following a sharp 30% decline in existing home sales since the beginning of the year.

“As the much-anticipated spring market unfolds, Toronto and Vancouver home prices are expected to remain hot while other markets will likely catch the home-buying fever.”

Petramala said there may be a jump in home-buying by year end as many are eager to get into the market before borrowing rates increase, which could happen, she said, as longer-term government bond yields “have already started to return to 2014 levels, which could push mortgage rates higher this year.”

The Teranet HPI looks at an aggregation of home value changes for homes that have been sold multiple times over a given period of time.