While U.S. president Barack Obama was promising in his inaugural speech to double investment in alternative energy over the next three years, politicians in Ottawa and Western Canada were promising an economic boom from oil and gas.

That worries Canadian clean energy CEOs and investors, who fear Canada may lose ground in an industry that is now worth $1 trillion and projected to grow to $3 trillion by 2020.

“We need to shape up a bit here in Canada if we’re going increase our market share of that economy,” said Ed Whittingham, executive director for the Pembina Institute.

In its new report, Competing in Clean Energy, the institute estimates Canada’s share of the $1 trillion market is just 1%. It concludes that, with the right policies, Canada could increase its market share to $60 billion by 2020 from $9 billion today.

Canada does not lack innovators in clean technology, nor has it lacked government support in the past. Vancouver’s Nexterra Systems Corp., for example, has developed proven bioenergy technology, thanks in part to government support, and is now hoping to enter the European market, where premiums for clean energy are much higher than in Canada.

But low North American natural gas prices and a redoubled focus in Canada on the fossil fuel industry are making it increasingly difficult for clean energy companies to compete.

Nexterra CEO Mike Scott was among the two dozen Canadian clean energy CEOs and investors interviewed by the Pembina Institute for its report. When he joined the company five years ago, natural gas prices were three or four times higher than they are now.

“That has a dramatic impact on the economics of what we’re offering,” he said. “I think government policy needs to recognize that – in the short term, at least – where fossil fuel solutions are much cheaper, you need some policy intervention.”

Nexterra has built seven bioenergy plants in Canada, and the U.S. and is now looking to enter the U.K. market.

“Unless we compete hard and are supported, it’s going to be very hard for Canadian companies to compete with domestic companies [in Europe] that have domestic markets that are much stronger,” Scott said.

The simplest, most effective way to support the sector would be putting a price on carbon, either through a national carbon tax or cap-and-trade system, Whittingham said.

But there are other things Ottawa can do to support the industry. For example, it could increase funding for Sustainable Development Technology Canada (SDTC), which has helped energy innovators like General Fusion leverage private capital.

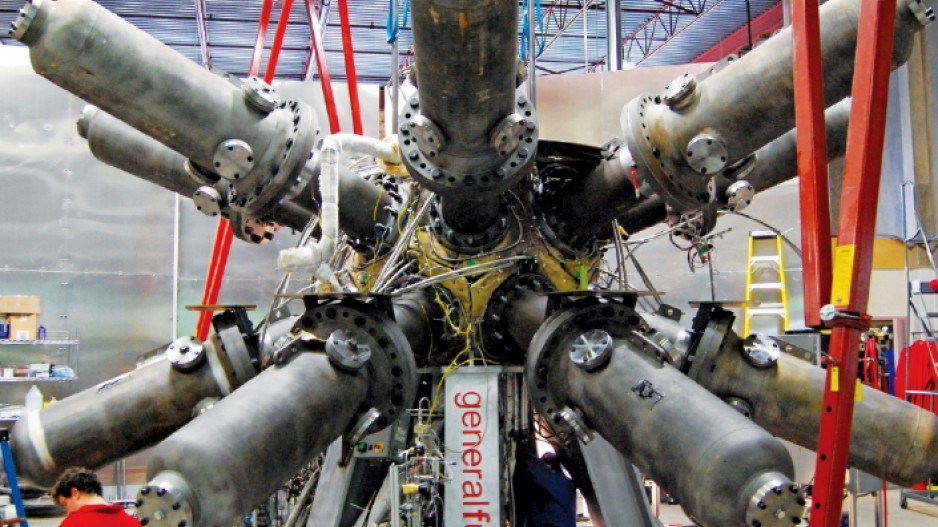

The Burnaby-based company is working on a $70 million prototype fusion generator that would produce energy from small amounts of heavy water (deuterium and tritium).

The company has received $6 million in SDTC funding, which helped it leverage another $32 million in private investment from venture capitalists, including Jeff Bezos, the founder of Amazon, and Cenovus Energy Inc. (TSX:CVE), which has kicked in $3.2 million.

General Fusion has gone from a staff of four in 2009 to 65 today and has spent about $5 million locally on supplies.

“It’s a great catalyst for bringing in outside capital,” Michael Delage, General Fusion’s vice-president of business development, said of the SDTC program.

“The energy industry is the biggest industry in the world, so the market opportunity is there that justifies the investment. The challenge is fitting within existing business practices and models. The way the energy industry and the venture capital industry have evolved, there is a hole there for how do we get these technologies through the development phases and into market.”

While some Canadians cringe at the idea of subsidizing clean energy through policies like feed-in tariffs, Whittingham said oil and gas exploration in Canada is subsidized through writeoffs and tax credits. At the very least, the Canadian clean-energy sector would like to see a level playing field.

“Canada has a long history of subsidizing fossil fuel producers,” Whittingham said. “You’ve got the OECD countries who have committed to stop doing that because it creates an artificial advantage for fossil fuel producers over clean energy.” •

Global share of clean energy patents

U.S.: 49%

Japan: 26%

Germany: 7%

South Korea: 5%

Canada: 2%

The Pembina Institute recommends a range of incentives to support the Canadian clean energy industry:

•carbon pricing (tax or cap- and-trade);

•phasing out of existing fossil fuel writeoffs and tax credits;

•fund SDTC to $100 million per year for next five years;

•developing a national energy strategy; and

•green bonds, fixed-income securities to raise capital for projects with environmental benefits.