Catalyst Paper Corp.'s (TSX:CTL) creditors have given the OK for a planned restructuring that will see the company sold.

Creditors rejected a proposed restructuring plan last month, forcing the company to seek a stalking horse bid. (See "Catalyst restructuring rejected seeks stalking horse bid" – May 24, 2012.)

Since the earlier restructuring plan was rejected, Catalyst was obliged to sell off its assets under terms of the Companies' Creditors Arrangement Act, and announced it would seek a stalking horse bid, a type of sale agreement that allows the company to select the initial bidder for its assets – likely the first lien holders.

Catalyst's new plan was approved by 99% of the company's secured and unsecured creditors Monday.

"The plan, which received creditor approval, today puts Catalyst on a stronger financial base to compete and adapt as the marketplace for our products continues to change," Catalyst CEO Kevin Clarke said in a press release.

"We're now turning our attention to securing our exit financing and satisfying the remaining conditions of the plan with a target timeline to emerge from creditor protection in the near term."

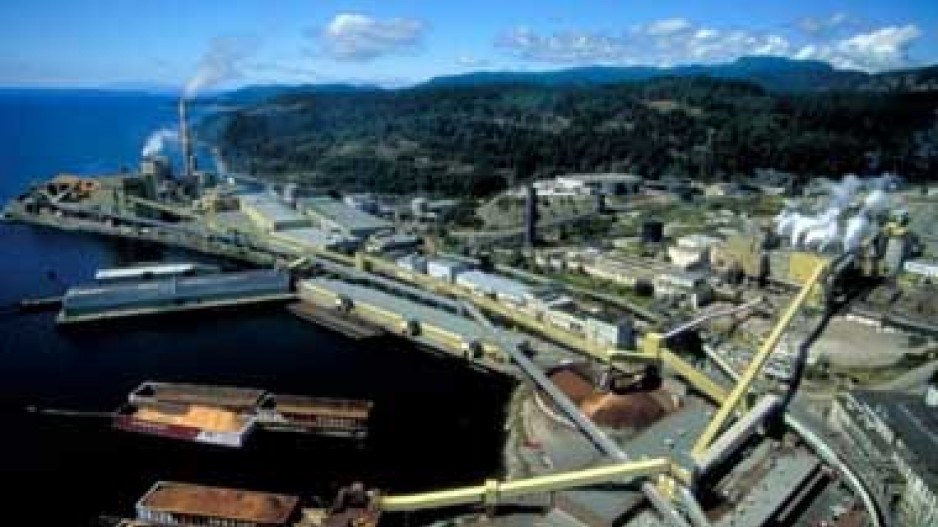

Catalyst employs roughly 1,200 people at its three B.C. pulp and paper mills. It also owns a newsprint recycling mill in Arizona. Falling sales of paper products in recent years put the company $1 billion in debt.

Now that Catalyst's latest restructuring plan has been approved by creditors, it needs to be approved by the courts in B.C. and in the U.S.

@nbennett_biv