Creditors have rejected a proposed restructuring by financially troubled Catalyst Paper Corp., which will now seek a stalking-horse bid for the sale of its assets.

Catalyst announced Wednesday that its creditors have rejected a restructuring plan the company had submitted, in an attempt to save the pulp and paper giant from bankruptcy.

Under terms of Companies' Creditors Arrangement Act, Catalyst is now obliged to sell off its assets.

In a press release, the company said it will seek a stalking-horse bid – one offered by a bidder preferred by the company in distress, which allows the company facing bankruptcy to prevent low-ball bids for its assets.

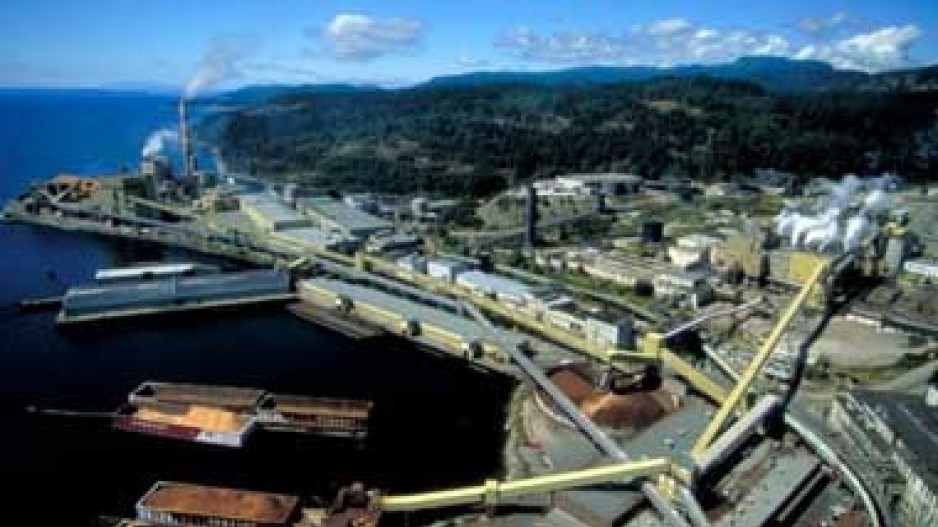

Catalyst CEO Kevin Clarke gave assurances that the sale of assets does not mean the pulp and paper mills it operates in Powell River, Port Alberni and Crofton will be close or sold off separately– only that their ownership will change.

"The cluster of mills in B.C. together are much more valuable together than not together," he said. "I think the fibre basket we have is excellent, the mills are operating well and we have a competitive labour agreement with our employees."

The digital age has taken its toll on pulp and paper makers like Catalyst due to falling demand for paper. Before filing for creditor protection, Catalyst was nearly $1 billion in debt.

In January, the Richmond-headquartered company filed for creditor protection, after workers at its Crofton mill rejected a labour agreement and restructuring plan that would have cut $315 million in debt from the company's balance sheet.

Union workers have since changed their minds, and agreed to a number of concessions.

See next week's issue of Business in Vancouver for more details on the sale of Catalyst's assets.