Three B.C. pulp mills are on the block after Catalyst Paper failed in a bid to have creditors approve its multimillion-dollar rescue plan.

The Richmond-based company, which employs approximately 1,200 workers in B.C., said last week it failed to garner enough votes from its unsecured creditor class to support its restructuring plan.

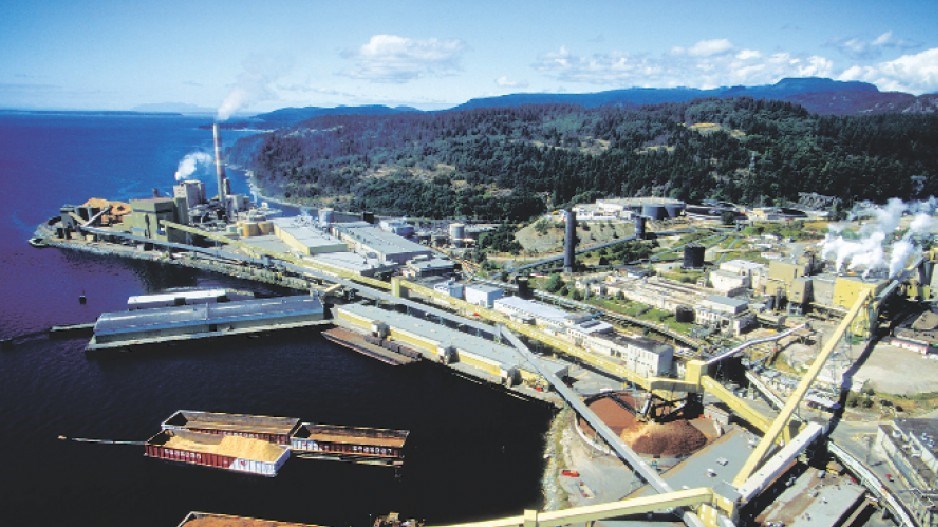

As a result, the company has been forced to put itself up for sale, selling the lion's share or all of its assets in B.C. and Arizona, where it also operates a mill.

Catalyst spokeswoman Lyn Brown said the company's mills would continue to operate as normal.

"We are extremely proud of our employees," said Brown. "They have done a tremendous job to maintain a business-as-usual environment during an unusually challenging period."

Company president and CEO Kevin Clarke noted the organization has retained its debtor-in-possession financing, providing it with the cash it needs to continue to pay employees and suppliers during the sale process.

Catalyst filed for creditor protection in January after years of poor fiscal returns amid an ongoing downturn in newsprint and directory paper markets.

In March, the company reached a five-year labour agreement with its unions, but it has since rescheduled its creditor meetings several times before the final restructuring plan was tabled.

The plan would have reduced the company's debt by US$435 million and given 50% of the net proceeds from the sale of its interest in Powell River Energy to unsecured creditors.

But now Catalyst must enter a stalking-horse bid sale process, a type of sale agreement that allows the company to select the initial bidder for its assets, which would likely be first lien holders.

An initial offering summary and confidentiality agreement has been distributed to first lien holders.

The process is expected to take upward of three months.

Once an acceptable purchase or investment bid has been selected, an auction for the company and its assets will occur.

Forest sector researcher Kevin Mason said he was surprised that the Catalyst's unsecured creditors rejected the company's restructuring plan, though he doesn't expect the sale process to affect the company's operations.

"It doesn't really upset the apple cart that much," said Mason, managing director of Equity Research Associates. "It's puzzling because the people that voted against it are going to end up in a worse state, whatever the driver of that is no one may know for sure."

Industry insiders have valued Catalyst and its assets at between $200 and $400 million.