Oil down; energy price uncertainty up.

That’s the 2015 energy sector script thus far, according to analysts, as oil prices slumped to five-year lows at the end of 2014 but forecasts for energy demand, especially in the Far East, continued to rise.

The shale hydrocarbon revolution will have a significant part in that script. But the relative newcomer that has unlocked previously inaccessible reserves of natural gas and oil will play far from a leading role, because, as Peter Tertzakian pointed out, production from unconventional horizontally drilled rock formations in North America is still small compared with production from the world’s conventional sources of onshore oil and gas from areas like the Middle East, Africa, Brazil and Russia.

Tertzakian, chief energy economist at ARC Financial in Calgary and the author of A Thousand Barrels a Second and The End of Energy Obesity, said unconventional sources in North America contribute a mere three million of the daily global oil production of 93 million barrels. Canada’s oilsands add another two million.

He said supply in the main oil-producing sector has not grown for five years as investment in conventional oil megaprojects has stalled in the face of declining revenue prospects and rising political and other risks.

A Goldman Sachs analysis widely reported in December underscored those risks. It estimated that plunging oil prices threaten to strand US$930 billion in future oil project investment.

Tertzakian said oil consumption will increase as its price drops, but the X factor in that growth projection is the global economy, particularly the Chinese portion.

“That’s the elephant that is going to dictate [by how much] because the greatest amount of growth is coming from there.”

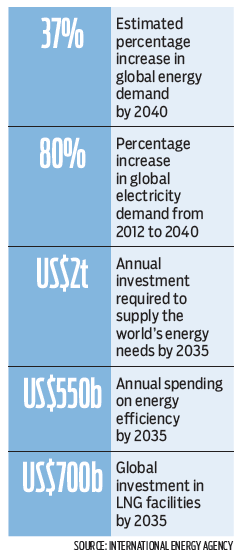

According to the International Energy Agency’s (IEA) World Energy Investment Outlook, global energy demand will increase 37% by 2040, and electricity demand will jump 80% between 2012 and 2040. Global demand for oil and natural gas is projected to rise 15% and 57%, respectively, by 2040.

The report predicts that China will eclipse the United States as the world’s largest oil consumer by 2030.

But for the energy sector, uncertainty over the pace of growth in China is matched by overall uncertainty in energy pricing.

According to Jeff Reilly, that uncertainty and its impact on demand and investment decisions in 2015 compared with the relative stability in commodity prices over the past few years is the overriding story in the energy sector.

“The conversation is so dominated by that [issue], it’s almost taking up all of the text,” said the group president, strategy and business development, at global engineering and project management company Amec Foster Wheeler (NYSE: AMFW).

Much of that uncertainty stems from geopolitical issues, because, as both Tertzakian and Reilly point out, the lion’s share of traditionally sourced hydrocarbons – approximately 88 million barrels per day – comes from other areas of the world.

“There are some very politically unstable producers in that group,” said Tertzakian, “especially places like Venezuela, so those are the wild cards [where] you don’t know what’s going to happen next.”

The instability of those regimes rises as oil prices drop.

Saudi Arabia’s refusal to cut its oil output, regardless of slumping prices, adds more uncertainty to the global oil equation.

While Energy Roundtable president Jason Langrish said global energy demand in 2015 will continue to accelerate, the increase will be slower than in 2014 “because economic growth is slowing everywhere except in the U.S., where energy efficiency gains are offsetting potential for demand increases.”

However, Tertzakian maintained that with the U.S. economy finally recovering and the pump prices of gasoline in some states about half of what they were during the recession, oil consumption in the U.S. will grow for the first time in five years.

While supply from unconventional sources continues to add to North American and global inventories, Tertzakian pointed out that the technology that shatters rock formations to extract the resource drains it faster than extraction through conventional wells and requires continual investment in drilling to replenish supplies.

Meanwhile, the prospects for renewable energy in 2015 and beyond are extremely upbeat.

The IEA outlook predicts that by 2040 it will account for nearly half of the global increase in power generation and overtake coal as the leading source of electricity.

But, as Reilly pointed out, low oil prices slow the development of renewables. Tertzakian added that the impact of renewable technologies on oil, which is primarily a transportation fuel, is “completely insignificant.”

They likely won’t be realized in 2015, but B.C.’s global liquefied natural gas (LNG) ambitions show promise in the long run.

In addition to the more than 50% increase in demand for natural gas over the next quarter-century, the IEA predicts that more than US$700 billion will be invested in LNG projects by 2035.

B.C.’s LNG sector faces numerous well-documented challenges, including lack of clarity on aboriginal involvement and the high capital cost of LNG infrastructure.

But Reilly is optimistic about its development on the West Coast. He said long-term global demand for LNG will continue to rise, and supply from major competitors like Qatar and Australia is already largely spoken for.

“[So] I really do believe [B.C.] is the next chapter in the LNG story.”