While steady signs of improvement were seen in mining activity last year, the exploration sector ended on a disappointing note in 2014, according to the latest study published by SNL Metals & Mining.

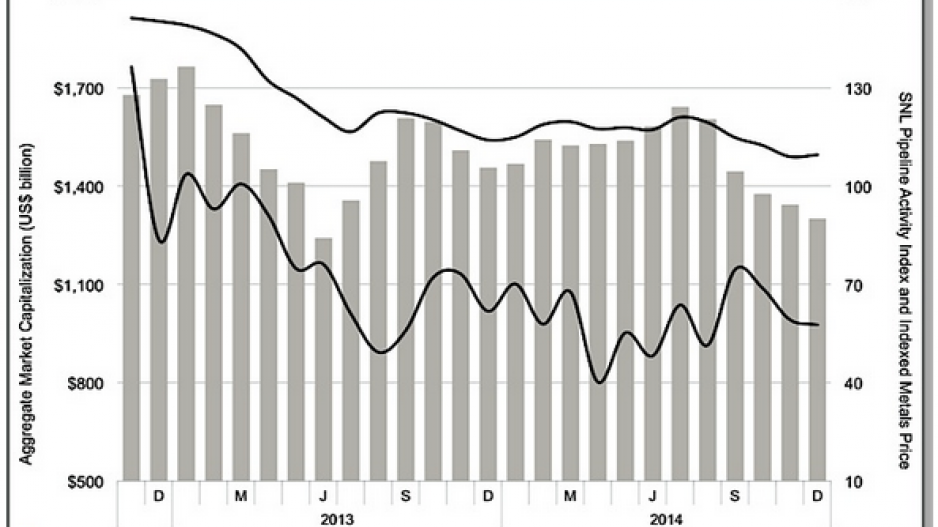

Depressed metal and oil prices are still weighing heavily on global exploration spending, with SNL Metals & Mining’s Pipeline Activity Index (PAI), which monitors the health of the sector, receding in December for the third consecutive month.

By the end of 2014 the mining industry’s combined market capitalization was estimated in a bit under US$1,300 billion, compared with over US$1,343 billion at the end of November and more than US$2,000 billion back in February 2012, the firm says.

And while SNL’s indexed metals price improved slightly in December, ending a four-month decline, the net positive value of the industry's project milestones in 2014 was only US$501 billion, compared with US$645 billion in 2013.

In a gloomy but telling summary: the mining industry has just suffered its fourth consecutive year of declining net milestone values.

Junior and intermediate companies' fundraising more than doubled from November to US$334.8 million in 32 financings, as some explorers cashed up for the coming season.

Despite the month-on-month increase, December's total fell short of the US$463 million raised in December 2013, and was the lowest December total since before SNL began tracking financings in 2008.

The 2014 total of US$5.55 billion in 329 financings was moderately short of the US$5.92 billion in 399 financings in 2013.

Last year ended with a total of 50 new resources valued at US$130.6 billion, compared with 68 valued at US$87.1 billion in 2013.