When it was first formed more than a decade ago, IBC Advanced Alloys (TSX-V:IB) was just another Vancouver-based junior exploration company, focused on developing new mines for beryllium, a rare metal that is highly valued in making high-performance alloys.

But by 2010, the company realized that, despite beryllium’s rarity and value, there was even more value in developing new beryllium-based alloys and applications. It therefore began a pivot that is transforming it from a resource company to an engineering and materials company.

“By 2011, we were aware the value chain in the rare earths and rare metals is very different in the value chain than more conventional metals and mining sectors – gold, uranium, the base metals,” said IBC CEO Anthony Dutton.

“You can generate significant value by owning an upstream asset in the more traditional base and precious metals sectors, whereas in the rare earths and the rare metals sector, the real value is created by owning the customer relationships.”

It has since divested itself of beryllium claims in Uganda, Brazil and the U.S. and bought or leased manufacturing plants in the U.S. that have been developing new alloys – the most promising of which is a beryllium-aluminum alloy called Beralcast, which is light but hard and has good thermal conductivity – characteristics valued by the defence and aerospace industries.

IBC’s first significant contract – announced in September – was with Lockheed Martin Corp. (NYSE:LMT) – a $2 million order for Beralcast for the housings of the electrical optical targeting systems for the new F-35 stealth fighter jet. The contract is for fewer than 100 planes; Lockheed Martin has orders for up to 3,500 F-35s.

“It’s possible we may be awarded additional components once we demonstrate that we can deliver the first one successfully,” Dutton said.

IBC also recently struck a partnership deal between its copper alloys division and Baoshida Swissmetal Ltd. and Avins USA Inc. to manufacture high-performance alloys for a range of applications.

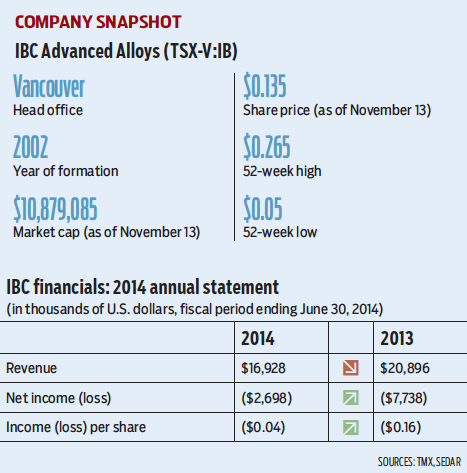

Despite pivoting from a junior exploration company to a manufacturing and engineering business, IBC’s stock has languished with other venture exchange junior mining and exploration stock, peaking at $5.82 in March 2008 and sinking as low as $0.05 per share in December 2013.

“I think it’s primarily because we’ve been caught in the venture exchange downdraft,” Dutton said. “A lot of the people who hold our stock also hold badly performing venture exchange stocks and we’ve just been caught in that.”

The company plans to eventually move to the big board or an American exchange.