But the provincial government has already had its knuckles rapped by the courts for the way it has treated Pacific Booker Minerals Inc. (TSX-V:BKM), which has been trying to get its Morrison Lake copper-gold mine approved since 2002.

Pacific Booker recently applied to have its mineral lease at Morrison Lake converted to a mining lease, which triggered the band’s warning to the government against approving the project.

The province’s handling of the $512 million project raises serious questions about B.C.’s environmental review process because it suggests that even projects that meet all criteria can be rejected for reasons other than environmental concerns.

On October 1, 2012, former B.C. environment minister Terry Lake denied an environmental certificate for the company’s Morrison Lake copper-gold mine.

Pacific Booker’s stock dropped 67%, from $14.95 to $4.95, in a single day on October 2, 2012, erasing $140 million in market capitalization. It now trades below $1 per share.

Pacific Booker challenged the decision in court in April 2013. Around the time it began its court action, an anonymous whistleblower provided the company with a report from the associate deputy minister for the B.C. Environmental Assessment Office (EAO). It differed from the one that was publicly released and that formed the basis for a final recommendation.

Based solely on environmental considerations, the EAO found no problem with the mine plan and made a positive recommendation.

But the EAO official recommended the project be rejected, contrary to the assessment’s findings. The leaked document was used in the company’s court case.

The BC Supreme Court found that “the process employed for applying for a certificate in this instance was fundamentally unfair.” It ordered the EAO recommendation be sent back to cabinet ministers for reconsideration.

Last summer, Environment Minister Mary Polak and Energy and Mines Minister Bill Bennett again decided against issuing an environmental certificate, and the company was asked to go through a supplemental application information requirements process.

Pacific Booker CEO John Plourde said that is tantamount to “go and start over again.”

Plourde has a seven-foot-high stack of documentation to prove that his company has done everything it was asked to do as part of the EAO process, which was supposed to take 180 days but took 794 and cost the company $10 million.

According to the leaked document Pacific Booker obtained, although former EAO associate deputy minister Derek Sturko had recommended the project based solely on environmental issues, he added other points for consideration, including the views of three First Nations and, in particular, Lake Babine Nation’s aboriginal title claim, which Sturko judged to be “moderate to strong.”

In other words, he appeared to be cautioning the government against triggering a potentially successful aboriginal title claim.

The company initially had a memorandum of understanding with the Lake Babine Nation. Plourde believes some of the nation’s leaders support the project, but said there is division within the community.

Lake Babine Nation Chief Wilf Adam last week warned the provincial government that approving the mine might jeopardize its co-operation on other projects, including the Prince Rupert Gas Transmission line, which would feed the $36 billion Petronas Pacific NorthWest LNG project.

“If they overturn or change their decision in favour of PBM [Pacific Booker Minerals] to start this mine, then all gloves are off – and any agreement we made with the province,” Adam told Business in Vancouver.

“They made the proper decision in the first place. If they change their tune on that, then it’s a different ball game. We’re not against mining or any big projects within our territories,” Adam added. “It just has to be done right.”

The question now, for Pacific Booker, is who gets to decide what “right” means: the B.C. government or Lake Babine Nation.

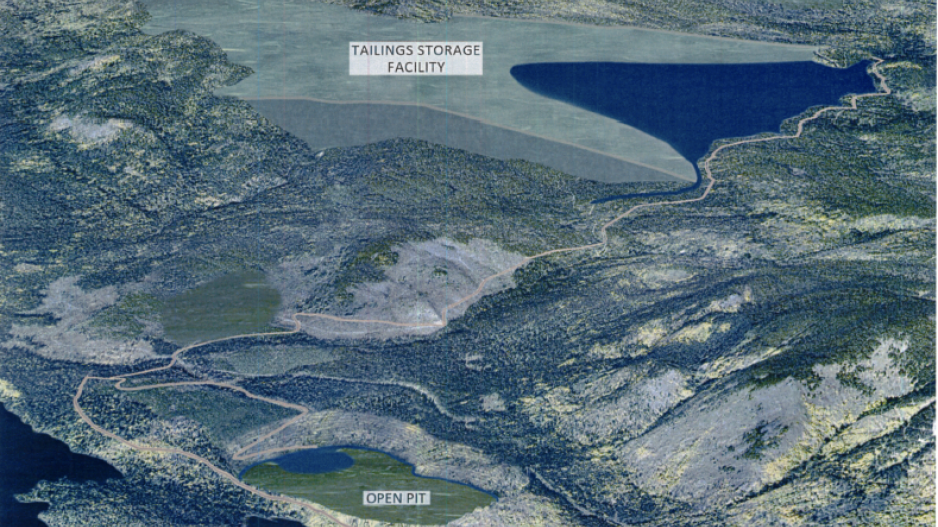

If it ever gets approved and financed, the Morrison Lake project would produce an estimated 30,000 tonnes of ore per day with a mine life of 21 years. The company estimates recoverable metals to be 625,000 tonnes of copper, 25 tonnes of gold and 4,559 tonnes of molybdenum.