If you went looking for a single place that defines the challenges, “pure grit” and giddy potential facing northern British Columbia, the District of Chetwynd could be a contender.

Located 1,000 kilometres from Vancouver and 304 kilometres north of Prince George, the remote resource town of 3,100 in many ways reflects the current reality of northern B.C.

Hammered by a decade-long downturn in forestry after the devastation of the pine beetle infestation and a more recent mining slump, Chetwynd, like most of the north, is poised for a big-time payoff when liquefied natural gas (LNG) plants fire up on the northeast coast.

Spectra Energy (NYSE:SE), Shell Canada and Talisman Energy (TSX:TLM) all have natural gas facilities in the area, working the giant gas fields that arc east to Dawson Creek.

Meanwhile, Chetwynd is bracing for the May 26 closure of Walter Energy Inc.’s (NYSE:WLT) Brule coal mine, the latest in a three-mine shutdown that has put close to 700 people out of work since 2013. But it is also welcoming the opening of a shuttered pulp mill as a sign of recovery in the traditional forestry industry.

On the horizon is a share in a proposed $12 billion TransCanada Corp. (TSX:TRP) LNG pipeline that would run east to the ports at Kitimat and Blue Fuel Energy’s planned $2.5 billion Sundance Fuels refinery that could someday turn natural gas into gasoline (see “Decision looming on Blue Fuel”, page 29).

“We have all industries – oil and gas, farming, sawmills, pulp. West Fraser is just opening a bioenergy plant and a pellet plant is coming soon. There is pure grit here. No matter what happens in the global economy, we can adapt,” said Chetwynd economic development officer Ellen McAvany.

Chetwynd Mayor Merlin Nichols said the opening of the old Tembec pulp mill reveals the flexibility of local workers.

“It [the pulp mill] shut down several years ago, and many of the workers went off to the coal mines,” Nichols said. “Now the coal mines have shut, many of the workers have gone back to the pulp mill.”

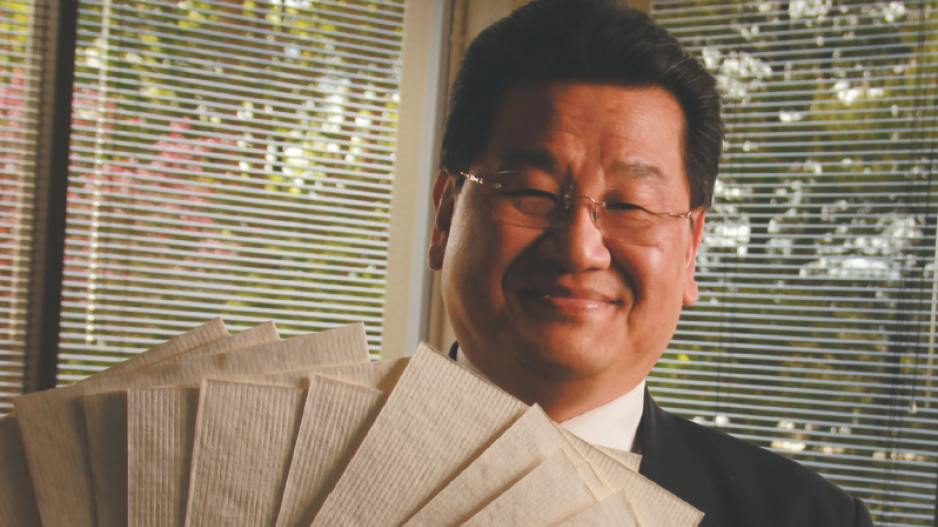

Richmond-based Paper Excellence (see story, page 30) officially brought the mill and its 136 workers back to work this month and will ship most of its specialty paper production to Asia.

Canfor (TSX:CFP) announced its plans for its Chetwynd pellet plant last fall. Once operating, the plant is expected to create 16 to 20 full-time positions.

West Fraser Timber’s (TSX:WFT) bioenergy plant is part of a complete rebuild of its Chetwynd sawmill.

The company has a 20-year purchase agreement with BC Hydro for the power that the plant will produce by burning waste-wood products.

Less wood in north’s future

But Chetwynd and its northern neighbours can’t count on the forest industry to reach its once lofty heights, cautioned James Gorman, president and CEO of the Council of Forest Industries (COFI).

The companies with the largest production within B.C. will be heavily affected by the mountain pine beetle infestation.

It peaked a decade ago, but the infestation’s impact is now hitting lumber production, as fewer of the dead trees can be manufactured into wood products. Overall lumber production in B.C. dropped in 2014 for the first time in five years, and Gorman said it won’t recover for decades.

COFI estimates that B.C.’s total allowable annual timber cut, which once averaged 72 million cubic metres, will drop to 62 million cubic metres this year and 52 million within five years and then level out at 44 million cubic metres per year in 2025 and for the rest of the century.

The annual allowable cut in the Dawson Creek timber supply area, which includes Chetwynd, remains at 1.8 million cubic metres, the same level it has been for 13 years.

Gorman added that falling lumber prices, a slower-than-expected U.S. home-building pace, a slump in the Chinese construction market, increased global competition and the return of duties this month on softwood lumber shipped to the U.S. combine to create a challenging year – and future – for northern wood producers.

It is LNG, therefore, where the long-term hope for Chetwynd and scores of other northern communities resides.

Calendars are being marked for mid-June, when the front-

runner, Malaysia-based Petronas, is expected to announce its decision on its $35 billion Pacific NorthWest LNG plant at Prince Rupert. In the wings is a similar-sized bid from LNG Canada, a joint venture that includes Royal Dutch Shell, PetroChina, the Korea Gas Corp. and Mitsibushi Corp. for a Kitimat facility.

The latter includes construction of a multibillion-dollar, 650-kilometre pipeline linking Chetwynd-area gas fields to Kitimat.

TransCanada hopes the pipeline can proceed in 2016 with an in-service date “by the end of the decade.” •