Skeptics who once wrote off Barkerville Gold Mines Ltd. (TSX-V:BGM) as a fantasy of founder Frank Callaghan may have to start taking the company and its plans to develop a gold district in the Cariboo a little more seriously, now that some serious players are getting involved.

Osisko Mining Inc. (TSX:OSK), the company that developed a gold mining district in the Abitibi gold belt in Quebec, and which successfully fended off a hostile takeover by Goldcorp. (TSX:G), is taking a 17% stake in the company.

"The acquisition of an 17% interest in Barkerville is consistent with our strategy of building a portfolio of direct and indirect interests in what we believe will be the next generation of long life Canadian gold mines" John Burzynski, Osisko's CEO, said in a press release.

Mining financier Eric Sprott, who owns the controlling interest in Barkerville, is selling half of his stake in Barkerville to Osisko.

Osisko, a mineral exploration and development company, will acquire 50,000,000 Barkerville shares at $0.80 per share. Barkerville’s shares were trading at $0.70 per share August 10.

Half of the shares will be sold to Osisko for $20 million cash. The other half will be acquired through an exchange of Osisko shares at $2.47 per share.

The transaction will leave Sprott, who currently holds 35.8% of Barkerville, with an 18.8% controlling interest. Osisko Mining will own 17%. Osisko Gold Royalties (TSX:OR), a separate but related company, will own 16.2%.

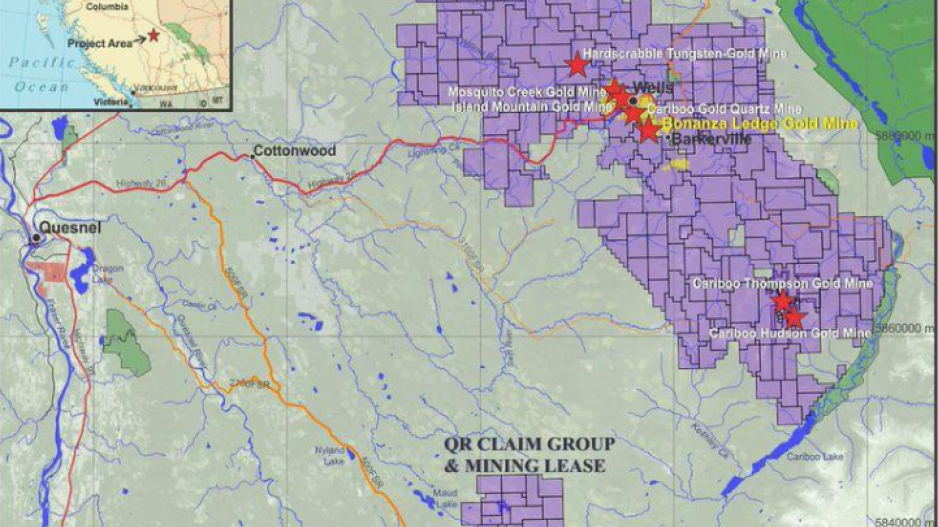

Barkerville was founded by Frank Callaghan, who managed to assemble a large belt of properties in the historic gold mining region of the Cariboo.

But the company was hit by a major crisis in 2012, when Callaghan, who was still CEO, issued a news release citing a questionable technical report that stated one of the properties, Cow Mountain, had indicated resources at 10.6 million ounces of gold at grades of 5.26 grams per tonne.

His claims were quickly challenged. The BC Securities Commission questioned the compliance of the company’s technical report and halted its shares for more than a year while the company commissioned a new resource estimate.

The new report forced the company to retracts its earlier claims.

Barkerville’s shares sank from $1.22 per share to a low of $0.21 per share as a result of the fiasco.

Sprott, who had been an earlier investor, save the company from ruin and ended up acquiring a majority stake in the company. Callaghan resigned and a new CEO took over.

For more on Barkerville's history, see New chapter in controversial Barkerville Gold saga .