The board of directors for PetroChina, one of five partners in the LNG Canada project, have unanimously approved a final investment decision on the LNG Canada project.

Korea Gas Corp. (KOGAS) has also voted in favour of a final investment decision, according to Korean news sources.

According to filings with the Hong Kong Stock Exchange, on September 28, PetroChina's board of directors approved its share of the LNG Canada capital project – US$3.46 billion ($4.5 billion Canadian).

According to reports by both the Chosun Ilbo and the Korea Economic Daily newspapers, the board of directors of KOGAS announced on Sept. 28 it will invest - through its 100%-owned subsidiary Kogas Canada LNG Ltd. - into the LNG Canada project. KOGAS, through its subsidiary, owns a 5% stake in LNG Canada.

The announcement did not disclose any financial figures of the investment, nor did it comment on whether a decision is coming from the four other partners in the LNG Canada joint venture. The KOGAS disclosure says it is up to each individual partner company to finalize their own investment decisions.

In its filings, PetroChina commits to spending US$335 million prior to the final investment being taken by all five partners. The board's approval of the spending was unanimous.

The other partners in the LNG Canada project are Royal Dutch Shell (40%), Malaysia’s Petronas (25%), and Mitsubishi Corp. (15%).

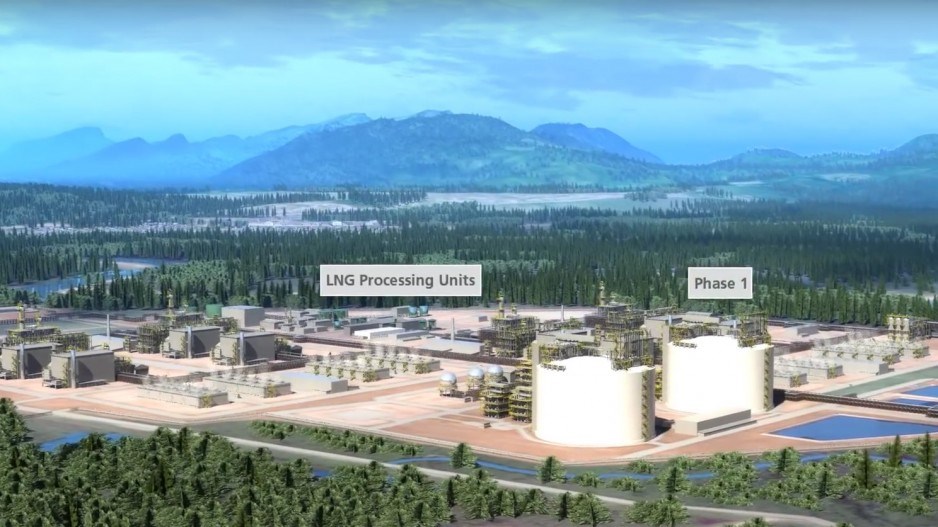

The LNG Canada project has been said to be worth $40 billion. But that is for the full build-out, which is a four-train project. The first phase is for a two-train project.

Based on PetroChina’s reported share of $4.5 billion, that puts the first phase of the project at roughly $30 billion, which includes the cost of the LNG plant in Kitimat and a $4.8 billion natural gas pipeline.

– With reporting by Chuck Chiang