A new manganese mine that Vancouver's American Manganese Inc. (TSX-V:AMY) plans to build in Arizona is feasible, but will cost five times more to put into production than originally estimated.

The mine would use a new technology for processing electrolytic manganese developed by Richmond's Kemetco Research Inc. The process is more energy efficient and would use less water than the traditional grinding and roasting processes currently used.

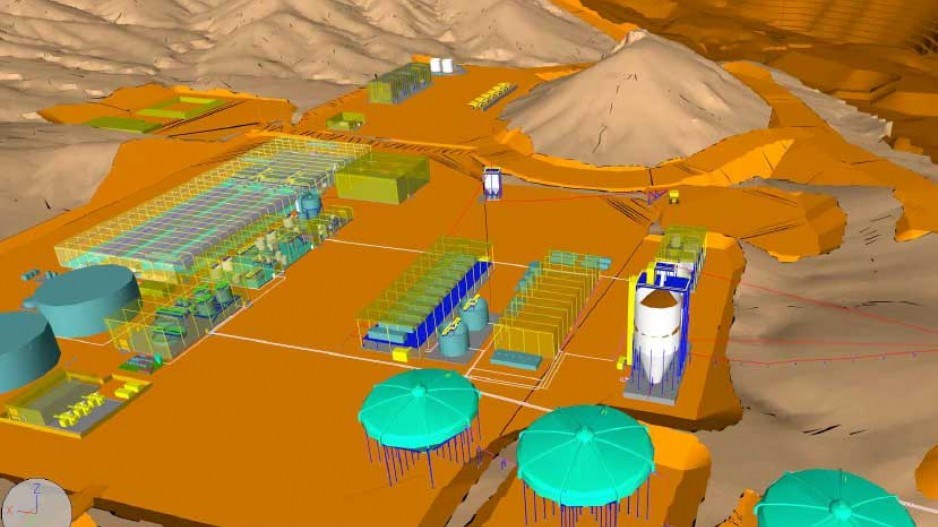

The Kemetco process has received third-party verification by Tetra Tech WEI Inc. in a recently released pre-feasibility report on the Artillery Peak Manganese Project in Mohave County, Arizona.

However, the report also concludes that the mine would cost $470 million to put into production – not $90 million, as originally estimated in 2009.

"It confirms that the process works," American Manganese CEO Larry Reaugh told Business in Vancouver. "We have higher costs and higher capital costs. But it seems that's the norm today. Everything's just going through the roof."

The Artillery Peak mine would produce electrolytic manganese metal, which is used to produce steel and aluminum.

The Kemetco process avoids traditional steps of grinding and roasting ore containing manganese – a process that is energy intensive and leaves behind impurities.

The new method uses chemicals rather than heat, and nanofiltration rather than evaporation to separate the manganese from the ore and clean up the water used in the process.

Reaugh said the mine is projected to have a return on investment in three-and-a-half to five years.

"It's still feasible," he said. "We're going to move ahead."

Asked how the company plans to bridge a $380 million funding gap, Reaugh said, "Probably a debt facility would be most of it. Bringing in a strategic partner would bolster the whole project. There is interest out there to bring in potential strategic partners."