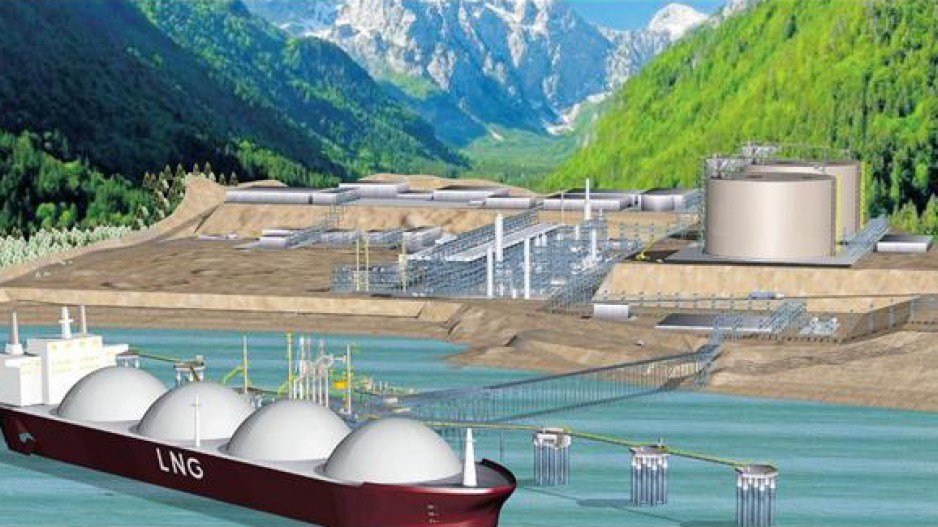

The timing of a final investment decision (FID) on the Chevron Corp.-operated Kitimat LNG facility will hinge on the proponents being able to secure sufficient gas contracts at a fair price, the CEO of the California-based company said January 31.

Company representatives have said on several occasions that they want at least 60-70% of Kitimat LNG supply under long-term agreement before announcing an FID. There’s also an opportunity for buyers to participate by taking an equity position. Chevron’s 50% partner in the project is Apache Corp.

“We’re doing site clearance now. One of the things we’ve learned on big land-based projects is get your infrastructure in order and housing and things of that sort, so that’s what we’re doing,” Chevron chairman and chief executive John Watson said on a conference call this morning, discussing 2013 fourth quarter and year-end results. “We’re pacing this project very carefully, as you would expect.

“What we have said is that FID will be entirely a function of gas contracts that allow us to develop the opportunity and provide energy to Asian markets at a fair price,” he added.

“It’s no secret that there’s a lot in the media on that subject right now. We’re actively working with gas customers today.”

Watson pointed out LNG projects are expensive and so “robust pricing” is needed.

“I think we’re going to need either oil-linked pricing or pricing that very clearly will give us the kind of return we need,” he said.

The company, meanwhile, continues its work in the Duvernay shale gas play in Alberta. Late last year, it released encouraging well results.

“We’ve got a couple of different shale plays going on in Canada,” Watson noted. “One is in the Duvernay, which is liquids-oriented. We’ve drilled, I think, we’re on our 13th well up there and have had some good success. We are looking to develop that and develop that at a good pace.

“Our approach to the shales is to make sure we understand what we’ve got and to plan in an orderly fashion so that we can keep costs in line commensurate with the production that we can generate,” he added. “The second, of course, is the Horn River and the Liard Basin, which is gas to support the Kitimat project. There will be additional drilling in the Liard this year to delineate those holdings.”

Chevron continued the trend of lower financial results for the majors as the company posted fourth-quarter net income of US$4.9 billion or $2.57 per share diluted, down from $7.2 billion, $3.70 per share diluted, in the 2012 fourth quarter.

Full-year 2013 earnings dropped to $21.4 billion, $11.09 per share diluted, down 18% from $26.2 billion, $13.32 per share diluted, in 2012.

Sales and other operating revenues in the fourth quarter of 2013 were $54 billion, compared to $56 billion in the year-ago period.

“Global crude oil prices and refining margins were generally lower in 2013 than 2012,” said Watson. “These conditions, as well as lower gains on asset sales and higher expenses, resulted in lower earnings. We continue to have an advantaged portfolio, and we have maintained our industry-leading position in upstream earnings per barrel for the past four years.

“Our strong financial position and healthy cash generation in 2013 have allowed us to fund a substantial investment program, add several new resource opportunities and, at the same time, raise shareholder distributions. Major capital projects currently under construction are expected to deliver significant production growth and shareholder value in the years ahead. We also raised the dividend on our common shares for the 26th consecutive year and continued our share repurchase program, both of which underscore our commitment to providing strong shareholder returns.”