Vancouver’s Ainsworth Lumber is merging with a fellow Canadian lumber giant in a deal worth $763 million.

Toronto-based Norbord Lumber announced December 8 it had signed a definitive agreement to acquire all the B.C. company’s outstanding common shares.

Ainsworth shareholders will receive 0.1321 of a Norbord share for each of their respective shares, representing a 15% premium to Ainsworth's average stock price over the past 20 days.

As of press time, Ainsworth stock jumped 9.9% to $3.28 following the announcement Monday.

Norbord CEO Peter Wijnbergen will lead the new company, while Ainsworth CEO Jim Lake will stick around for six months as an advisor.

“This creates great opportunity for our company, our employees and our other stakeholders,” Lake said in a conference call with investors.

“For our shareholders, in particular, this transaction offers tremendous opportunity.”

Brookfield Asset Management owns a majority stake in both companies and would control 53% of outstanding shares in the merged company.

The deal is still subject to approval from minority shareholders of Ainsworth and Norbord. Special meetings will be held in January to allow shareholders to vote on the transaction.

Board members of both companies not affiliated with Brookfield have already approved the deal.

Wijnbergen said the merged company would be in a better position to benefit from improved U.S. housing starts.

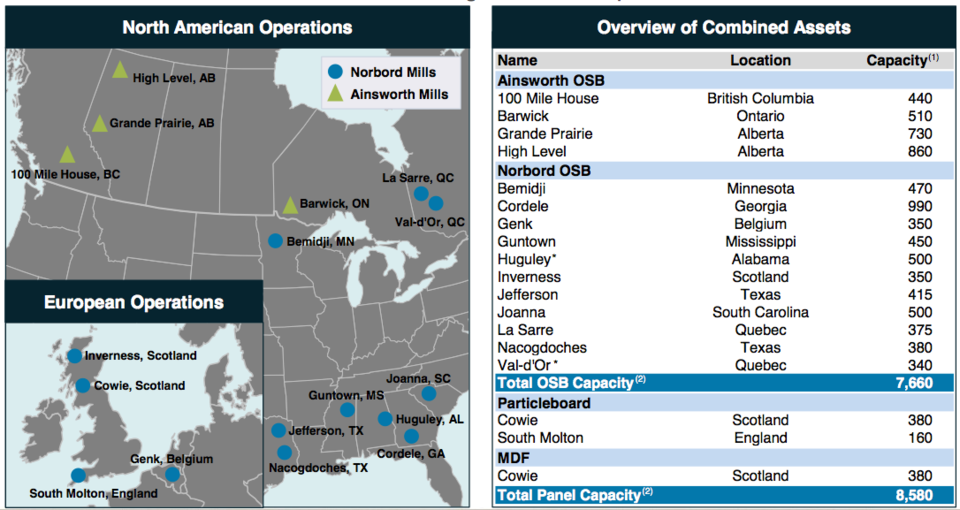

Both Ainsworth and Norbord specialize in oriented strand board (OSB), a type of engineered particleboard used in construction.

Ainsworth, which made $10.6 million in profits during the third quarter of 2013, posted a $36.4-million loss in Q3 2014.

PwC forest, paper and packaging analyst Kevin Bromley told Business In Vancouver last week OSB had been performing very poorly lately due to an oversupply in the market.

A deal announced in September 2013 would have seen Tennessee-based Louisiana-Pacific buy Ainsworth for $1.1-billion. That transaction fell apart in May following scrutiny from regulators in Canada and the U.S.

[email protected]