The world’s oil and gas super majors — BP, Chevron, ConocoPhillips, ExxonMobil, Royal Dutch Shell and Total — have all seen their earnings in the upstream segment fall in Q3 2014 since Q2, according to a new Evaluate Energy analysis of the companies’ recently released quarterly results.

This drop is in no small part attributable to a fall in global realized prices for these companies, proving that it doesn’t matter how big an oil company you are, you are still susceptible to price changes.

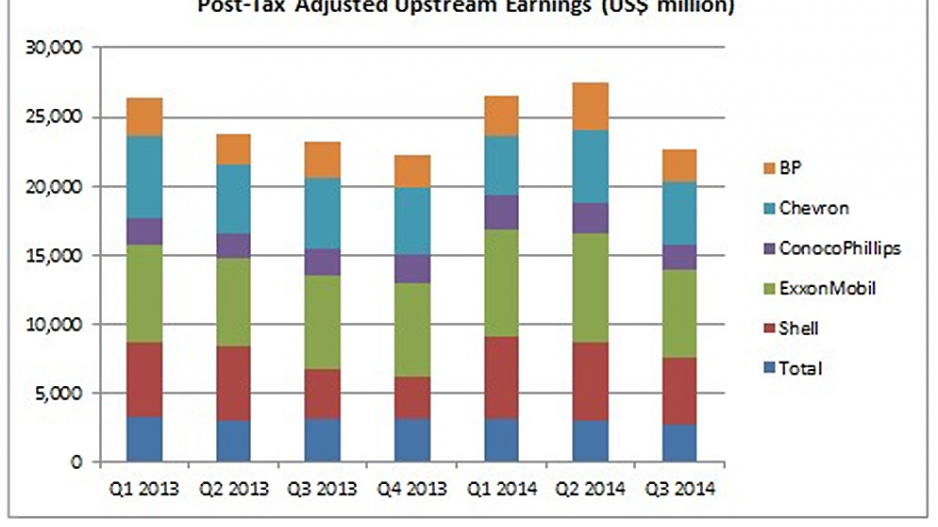

In fact, this quarter has been amongst the worst for this group of companies as a whole in the upstream sector over the last 2 years. The chart below shows the companies’ quarterly adjusted upstream earnings (see Note 1) in 2013 and 2014.

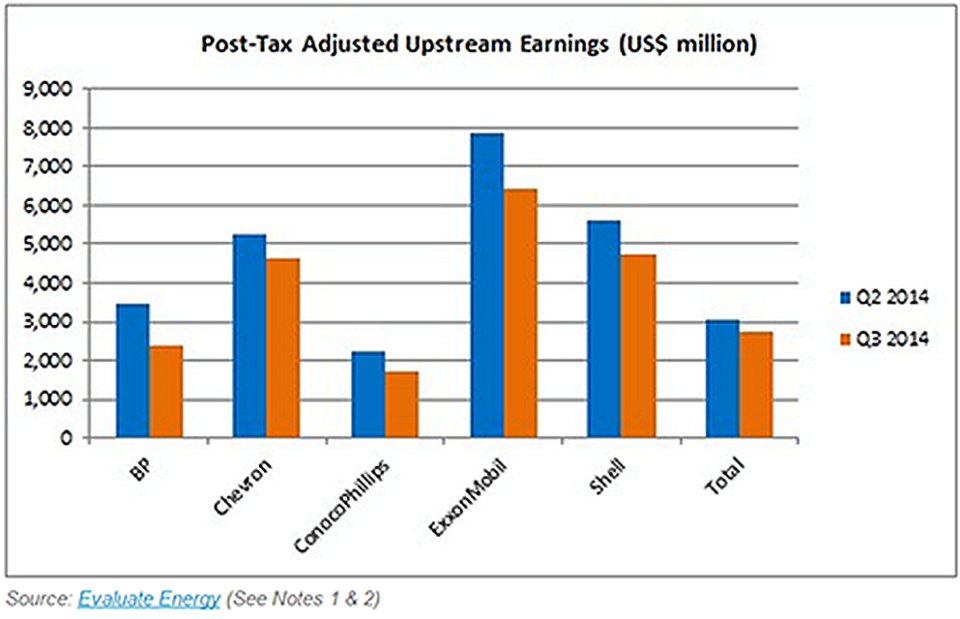

This is a complete reversal of the trend over the past 6-9 months; the first and second quarters of 2014 both saw an increase on the previous quarterly earnings. Q3 2014 saw a fall in earnings for all six companies in the upstream segment since Q2. The biggest total drop was for ExxonMobil, whose adjusted earnings fell by $1.465 billion (19 per cent) to $6.416 billion in Q3 2014. Percentage-wise, BP suffered the biggest fall, recording a 31 per cent drop off on Q2 earnings.

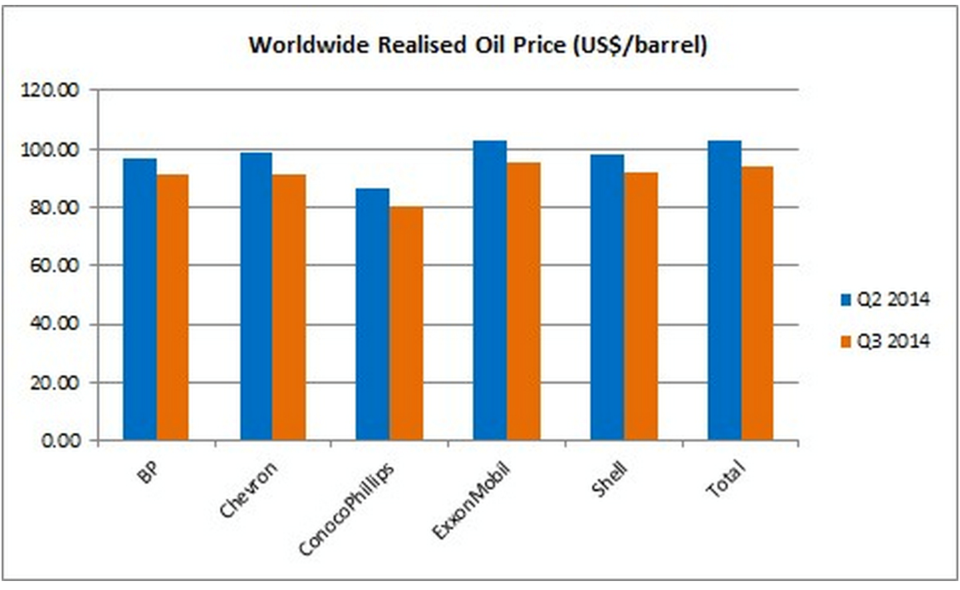

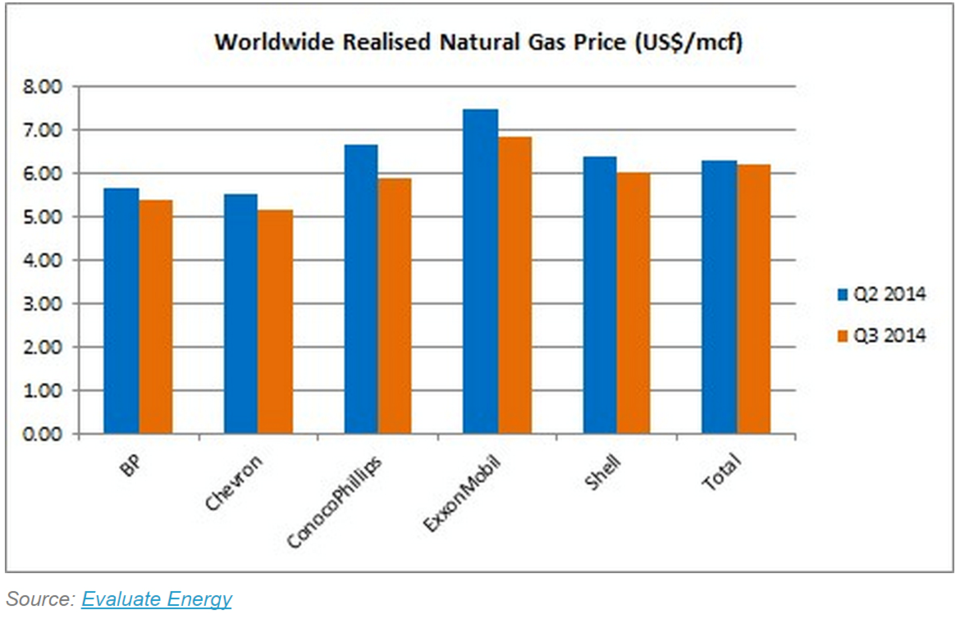

Each company will have its own set of reasons for the fall, but one factor that has impacted the entire group is a fall in worldwide realized prices this quarter. The group’s realized oil prices fell on average by seven per cent from $97.59 per bbl in Q2 to $90.72 a bbl in Q3, whilst gas prices fell by six per cent from $6.34 per mcf to $5.93 per mcf. The biggest fall in oil price was suffered by Total, whose price fell by $9.00 per bbl (nine per cent) in Q3 to $94.00. The biggest fall in gas price was suffered by ConocoPhillips, an 11 per cent fall to $5.91 per mcf from $6.66 per mcf.

Notes

1) “Adjusted earnings” as referred to in this report represent post-tax earnings after the removal of the one-off effect of non-recurring items, which included items such as impairments, gains/losses on asset sales, legal costs, and unrealized gains/losses on hedging agreements. This measure is important for benchmarking, as each quarter is more comparable to previous or following quarters.

2) All of the companies report adjusted earnings on a post-tax basis, except for BP, whose post-tax position has been estimated using the reported pre-tax figures and the average effective tax rate over the past 3 years.

3) Rosneft is also considered to be a Super Major by Evaluate Energy, and although it saw a 37 per cent fall in overall upstream earnings in Q3 2014, it does not report post-tax earnings by segment, segmental earnings adjustments (see note 1), or realized prices, so had to be left out of this report.