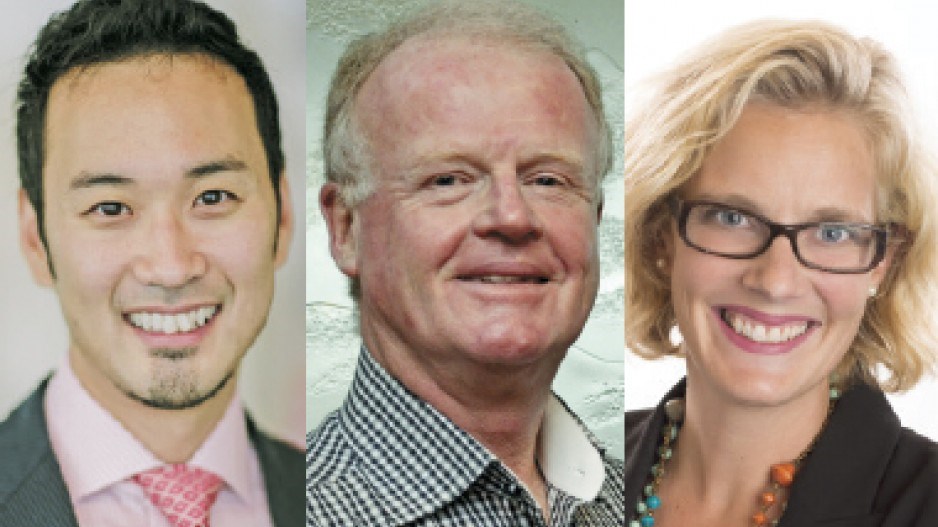

Anthony Okuchi: Manager of operations, Vancity

Congratulations on starting your business. You’ve made the leap, but now what? Remember a banking partner is a long-term relationship, and you should be looking to them to provide you with advice, collaborative opportunities, advocacy on emerging issues and access to a variety of grants, capital and growth financing.

•Is it all about low interest rates and fees?

It’s important to consider more than just financial rates. Make sure your financial institution has a broad range of support that includes creative financing arrangements that help you achieve success by giving you the right advice at the right time. Take the time to have that first in-depth conversation with your financial institution to make sure they’re on board to support you for the long term.

•What should you look for in your business banker?

The key question is, do I have a banker who is in my corner? Do they understand my business, and my local community where I sell my goods? Are they thinking ahead about what I need before I am aware of it and will they be flexible when times are tough? Do they add value in ways beyond just financing? Do they create a supportive ecosystem through contacts, customers and relationships to help me build my business?

•Will your banker be able to grow with you and your business?

The reality is, unlike consumer credit scores, which follow you from institution to institution, your business history is only with the first institution you do business with. Therefore, moving is a massive undertaking, and you need to look for someone who will grow with you.

Bill Brooke: Director, business banking, Coast Capital Savings

The biggest mistake a small-business owner can make is opening a small business account at an institution simply because it’s the closest or it’s where they have always banked. Small businesses have specific needs. Take the time to research your options and find your perfect fit. Here are some of my top tips on how to do that.

•They’re just not that into you. Make sure that your institution supports small business and has the products and team to help your business succeed. If not, that tells you where on its priority list you’re going to fall.

•Time is money. When you’re looking for a small-business banker, keep your business objectives front of mind. Ensure that your relationship manager is going to dedicate the time necessary to understand the intricacies and nuances of your business.

•One size doesn’t fit all. This is true for personal and business banking. Find a business banker that provides solutions that will take your business to the next level. This includes everything from cash management solutions to a suite of insurance products that protect your business from events that have the potential to devastate.

•Help them help you. Cliché perhaps – but ensure you have all your ducks in a row so that they have the information they need to build a custom plan for you. That means having a detailed business plan, cash-flow projections and financial statements – both personal and business – from at least the past three years.

•Simply put: take your time. Do your research and don’t be afraid to ask for the time you need from your small business banker. They should be as invested in your success as you are.

Katherine Britton: Business adviser, Women’s Enterprise Centre

Although some might argue that banking is a commodity, the reality is that banks have different offerings. Some financial institutions are great for large corporations, while others offer services geared to small/medium enterprises. It’s worth spending some time in the beginning to make the right decision, because it’s a pain to change banks or credit unions once you’re already established. Three important things to consider when shopping around are fees, convenience and service.

•Fees. It’s important to look at both transaction fees and interest rates. Depending on your needs, you might want an account with unlimited transactions or inexpensive wire transfers. Estimate what your business will require monthly and see which bank or credit union offers the most economical package for your business.

•Convenience. Another practical issue to consider is availability. Does the financial institution have locations and hours that are convenient? Do it have a good ATM network? Does it offer online services and a mobile app?

•Service. You may like to do everything online, but occasionally you might want to talk to an account manager. Over the years, financial institutions have automated more of their processes/services, and some don’t have dedicated account managers to handle your small business account. If this is important to you, be sure to ask how the bank handles its business accounts. Because account managers typically move positions every two years or so, it’s best to avoid choosing a financial institution solely because you like the account manager.