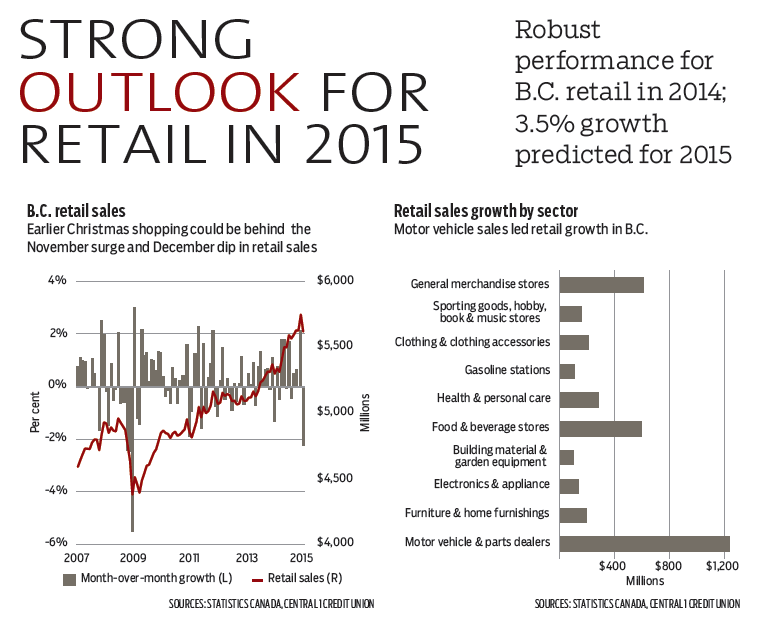

Similar to the national picture, retail sales in B.C. ended the year on a disappointing note despite a strong performance for the year as a whole. After a November surge in sales, retailers retraced all of the gains in December as dollar-volume sales dropped 2.2% to a seasonally adjusted $5.62 billion. This pushed sales down to the lowest level since August. The more than 2% decline in month-to-month sales was the sharpest since late 2008, although it bears repeating that this followed an above-average gain. This up-and-down pattern could point to a pull-forward of sales into November, as retailers offered early holiday sales.

According to data from Statistics Canada, the monthly sales declines were broad-based among retail sectors, with sales at clothing stores, electronics/appliance retailers and gasoline stations leading the decline. Excluding automotive-related and gasoline sales, which provide a better measure of underlying demand, core activity fell 2.6% from November.

Despite the pullback in December, annual retail sales remained elevated for the year. Total B.C. sales climbed nearly 6%, compared with a 4.7% national performance. Metro Vancouver led provincial sales with a 7% gain from 2013, while growth in the rest of B.C. reached a still-robust 4.8%. All sub-sectors gained during the year, with growth led by motor vehicle and related sales (9.3%), furniture and furnishings (9.9%) and general merchandise (8.5%).

Lower prices held the dollar-volume growth of gasoline sales to 1.4%. Using national retail price inflation as a proxy for B.C., real retail sales climbed about 5% in 2014.

We anticipate that retail sales will climb about 3.5% this year. While stronger hiring momentum and tourism activity will lift sales, decelerated growth in the housing markets following a solid 2014 is expected to dampen sales growth. •

Bryan Yu is senior economist at Central 1 Credit Union.