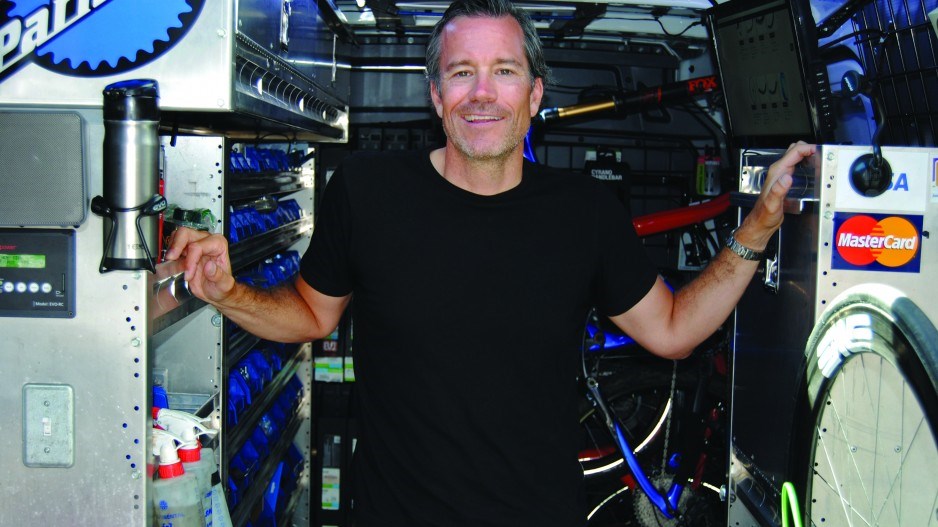

You could call James Wilson obsessed with cycling.

“Some would say I came out of the womb with a bicycle,” he said, laughing. Twenty-five years after winning the BC Cup in mountain biking, Wilson cycles fives days a week and runs Obsession Bikes in North Vancouver, which he started more than a decade ago.

“My intention is to sell a family a lifetime of bikes; that’s what I’m doing,” explained Wilson, who also serves as vice-president of retail with the Canadian Independent Bicycle Retailers Association. And he can: prices have fallen over the last two decades, and the products have improved.

It’s competitive, however. Wilson said he’s facing 11 other retailers in his community alone, not to mention competition from suppliers selling straight to consumers. He competes for family recreation dollars, and with shrinking margins.

Today, many vendors require retailers to commit to matching their online pricing. Add to that the fact that parts can take anywhere from three to 10 days to be delivered, and you have a confluence of factors that is killing the bike business, Wilson said.

Wilson keeps a large inventory of parts so that he can turn around repairs in 24 hours, instead of days.

“There’s no two ways around it. The margins are falling in the bike business, and the bike retailers have to be more intelligent. I think what the margin challenge is forcing us all to do is to rethink how we run our businesses.”

In 2013, Velofix co-founders Chris Guillemet, Boris Martin and Davide Xausa did just that. Frustrated with the traditional servicing model of lugging a bike to the shop on time only to face repair delays, the trio created a bike shop on wheels – literally – that ditches the bricks-and-mortar model for a mobile one, mechanic and all.

“We didn’t really know the ins and outs of the industry, and when we launched the business and we built what we thought was a really cool truck and a cool business, we found out quickly that nobody would sell to us because we weren’t a brick-and-mortar store,” explained company CEO Guillemet.

Twenty-eight bike brand partnerships later, and with 109 U.S. and Canadian franchises and counting, Vancouver-based Velofix has shaken off any initial challenges and is deftly weaving around the obstacles facing what Guillemet describes as a “very, very conservative” industry.

“A lot of people in the industry didn’t want to see change. We were a bit of a disruptive model.”

Using a smartphone, cyclists can punch in a postal code and book an appointment with a Velofix mechanic. On a set date at a set time, a bright red van that Wilson describes as “a bike nerd’s dream” will come directly to the consumer at home, at work or just about anywhere else.

Personal requests make up the bulk of Velofix’s bookings, but Guillemet said the company’s corporate business is picking up, with clients like Microsoft (Nasdaq:MSFT) and Google (Nasdaq:GOOGL) paying for Velofix to provide mechanical support for fleets of bikes used by employees to commute to and from work or between campuses.

Charles Chang, founder and president of Lyra Growth Partners, was an early investor in Velofix, as was Boston Pizza International co-founder Jim Treliving. When Chang came on board, the challenge was figuring out how to scale the company effectively.

“The biggest decision was whether we were going to do it corporately or do it through franchise,” Chang said. “We felt that nothing is faster … than franchise.”

For a $25,000 fee, franchisees get a van outfitted with tools, a flat-screen TV and a coffee machine in about 100 square feet of space. Velofix takes an 8% royalty fee and provides owners with sales, marketing and software support.

Franchisees – either mechanics investing as owner-operators, or investors buying the rights to one or more territories – handle inventory and parts distribution.

In addition to offering repairs, Velofix also sells bikes through its website, which provides a revenue stream without requiring the company to stock a lot of inventory.

“The beauty of this business is the consumer buys from the manufacturer, and we enable it,” Chang said. “There’s no overhead costs for us to be a bike reseller, and that’s the magic of it.”

While the company’s financials are confidential, Guillemet said the revenues for Velofix Direct – where bike manufacturers sell to consumers through Velofix, which delivers, assembles and checks bikes – are climbing month to month.

“More and more people are wanting to buy bikes online now, which is great, but a lot of those people can’t build them or maintain them themselves, so that’s where we come in,” he said. “I don’t know if we could have said in less than five years we would add 100-plus trucks, but we’re happy with where we are today.”•