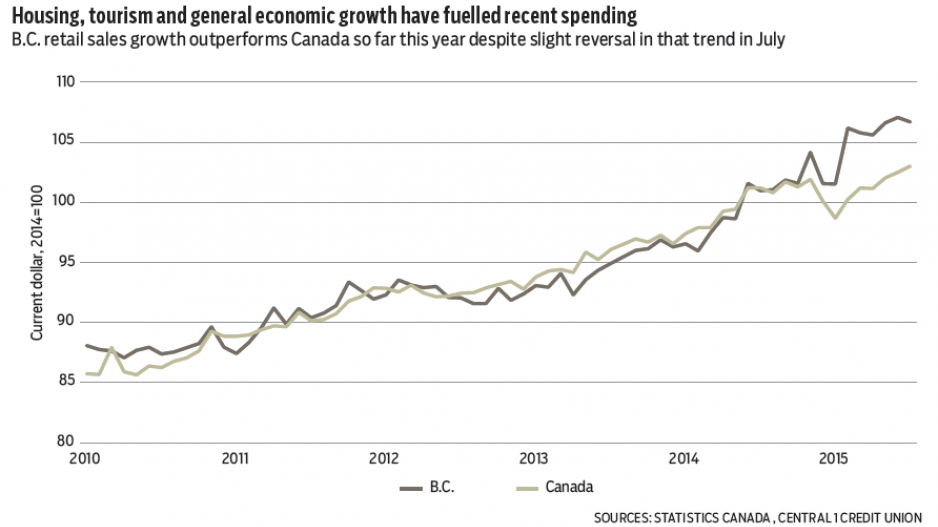

B.C.'s retail sector posted another strong sales performance in July, despite slipping fromJune. Total dollar-volume sales estimated by Statistics Canada reached $5.89 billion during themonth, marking a drop of 0.4% from June and underperforming a national gain of0.5%. Nonetheless, sales remained near recent record highs and point to arobust spending environment in the province, driven by housing, tourism andgeneral economic growth.

Year-over-year salesgrowth continues to outperform the nation by a wide margin, with 5.7% growthduring the month, compared with 1.8% nationally. With the exception ofgasoline, sales are up sharply across all retail categories.

Through seven months,provincial retail sales are up a robust 7.3% owing mostly to a near 11%increase in Metro Vancouver, which is being boosted by a flurry of housingdemand and rising tourist activity. Although the weak Canadian dollar islifting prices for some products, retail price levels are broadly in line witha year ago. Average national retail price levels are essentially unchanged, andconsumer price inflation in B.C. remains low. Vendors may be adapting to higherimport prices through increased operational efficiencies or taking less margindue to a competitive environment, although more cost pressure is likely to passthrough to consumers. Full-year retail spending growth in B.C. is forecast toreach 5% this year and hold steady at 5.5% in 2016.

Housing as a key growth pillar in B.C.’s economy was further solidifiedwith last week’s release of new home investment estimates. Gearing off thestrong data flow for building permits and housing starts in recent months, newhousing investment climbed for the second consecutive month in July, buildingon a nearly unbroken string of monthly gains since mid-2013. Current-dollarinvestment reached $753.5 million in July, which was up 19% from a year ago.

Strong housing-starts momentum has lifted year-to-date investmentspending by close to 15% in current- and constant-dollar terms. Interestingly,gains have come in the lower-density single-family and attached markets, whileapartment investment is up a relatively modest 11% in real terms, whichreflects stronger new home activity in markets outside Metro Vancouver.

The pace of B.C. housing investment means our forecast of 6% realresidential investment growth in 2015 will be surpassed.

Strength in new dwelling construction, which makes up about half ofresidential investment, and strong renovation and acquisition-relatedactivities owing in part to a robust resale market could lift real residentialinvestment growth to about 10% this year. •

Bryan Yu is senior economist atCentral 1 Credit Union.