Smaller and nimbler competitors have been nipping at Vancouver-based yoga wear giant Lululemon Athletica Inc.’s customer base and grabbing market share.

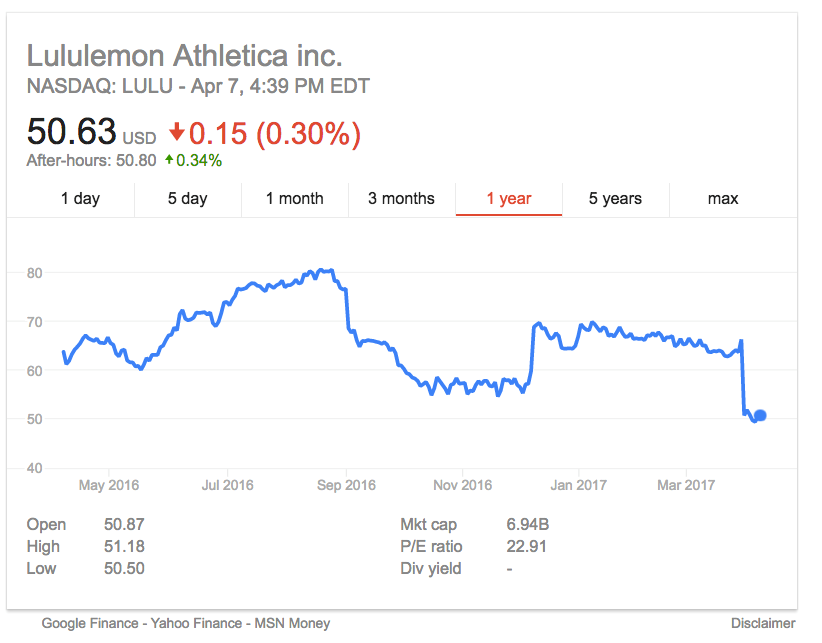

The result is that Lululemon’s late-March earnings report disappointed investors, and its CEO, Laurent Potdevin, forecast sluggish sales – something that sent its shares (NYSE:LULU) below the US$50 mark in early April for the first time since 2014.

“What [Lululemon] is lacking is a vision,” Lululemon founder Chip Wilson told CNBC after hearing Potdevin’s remarks. “I don’t think anyone knows what the vision is.”

He added that analysts no longer accept Lululemon having high price-to-earnings multiples because the company is no longer a leader in innovation.

Wilson, who left the Lululemon board of directors in 2015, has since bankrolled Kit and Ace, which sells streetwear and clothing made with “technical cashmere” and other proprietary fabrics.

That venture launched in 2014 and rapidly expanded to 700 employees and 61 stores in early 2016. But growing pains forced layoffs, and the company’s store count has fallen to 41 stores.

Kit and Ace’s sales might have attracted some Lululemon customers, but the company operates in a slightly different fashion niche from that of Lululemon, said Retail Insider Media owner Craig Patterson, who believes other competitors are starting to eat Lululemon’s lunch.

“Montreal’s Lolë is definitely the biggest competitor right now to Lululemon,” he said. “They are doing really well.”

Lolë’s website lists 32 Canadian locations, including five in B.C., as well as hundreds of other retailers that carry Lolë products.

Countless independent yoga wear sellers have also sprung up.

New Westminster’s Inner Fire, for example, markets “hand-made yoga apparel.”

Vancouver’s RYU (TSX-V:RYU) is one of the more successful of the startups. It has expanded from one store on West 4th Avenue in late 2015 to three. Its other stores are on Thurlow Street near Robson Street and, as of this month, at Park Royal in West Vancouver.

CEO Marcello Leone told Business in Vancouver that by June he expects to open a store in Burnaby’s Metrotown and one in Toronto.

“We will have an announcement for a launch into the U.S.,” he said. “That could be the last quarter of 2017.”

(Chart: NYSE:LULU after trading closed on April 7, 2017 | Google Finance)

RYU’s sales surged 57% to $1,367,043 in 2016 from $869,917 in 2015, although the company lost more than $5.6 million during the year, according to its March 30 earnings report.

Leone said RYU’s loss was necessary to establish the brand and that the company should break even by mid-2018.

RYU sales growth has also come from partnerships with established Vancouver companies. RYU-branded yoga tights, T-shirts and backpacks are sold wholesale to YYoga, which sells them to its tens of thousands of members at some of its eight locations.

The Vancouver Canucks also sell some RYU products at Canucks stores at Tsawwassen Mills and at Rogers Arena.

(Image: Clothing hangs on racks at RYU's new store at Park Royal | Rob Kruyt)

“It’s brilliant any time a retailer, especially one that is trying to build its brand awareness, can work with an established company or brand, like YYoga or the Canucks,” said Patterson. “It is a great move for both companies but particularly for RYU because it is getting established.”

Another positive thing for RYU is that it has managed to develop an online sales channel.

About 20% of RYU’s sales derive from e-commerce with about 40% of those sales coming from Americans.

The brand also has appeal outside of yoga wear as its sportswear competes with brands such as Under Armour (NYSE:UA) and Nike (NYSE:NKE).

(Image: TSX-Venture:RYU after trading closed on April 7. Chart says 3:11 p.m. EDT because no shares traded after that time | Google Finance)

Leone, the son of the founders of the upscale Leone boutique on West Hastings Street, said 51% of RYU’s sales are to women and 49% are to men.

“It is very rare to see that kind of split,” he said. “Our stores have distinct sections for men and for women as well as one for bags and accessories. As we grow, we might take a smaller-footprint location and open a bags store in a certain demographic area. I don’t like to say ‘no’ to things but at this point, things are working well with segregated areas inside RYU stores.” •