Blindsided

Building owners are busy determining the impact of the BC Liberals’ budget announcement that the school tax credit will be phased out by 2014 for light industrial (Class 5) properties.

“It surprised us. We weren’t aware of that coming down the pike,” said Paul LaBranche, executive vice-president of the Building Owners and Managers Association of BC (BOMA BC). “We’re supportive, in principle, of good fiscal management, balanced budgets and all that ... [but] we wished that we’d had some indication that it was coming.”

Similarly, Gord Wylie, co-chairman of the development issues and government relations committee of commercial real estate association NAIOP, said his organization wasn’t consulted.

While neither BOMA BC nor NAIOP have calculated the impact of the change, the province says the credit, introduced in 2009, “will effectively decline from 60% to 30% for the 2013 tax year, falling to zero for the 2014 tax year.”

David Howard, director of realty tax consulting with Altus Group in Vancouver, said that for a property such as the 210,000-square-feet Purolator building at 3700 Jericho Road in Richmond that will mean a 14% increase in taxes – from $453,000 in 2012 to approximately $516,000 in 2014.

“It’s going to impact distributors and light manufacturing,” he said. “It’s going to hit them right away.”

Wylie said he hopes Victoria finds ways to make the tax credit’s withdrawal worth the pain.

On the rebound

The outlook for U.S. real estate continues to improve, with financing becoming more available and companies showing confidence – regardless of the latest round of fiscal wrangling in Washington and the impacts of budget sequestration in the U.S.

Chris Addicott, an attorney with law firm Hillis Clark Martin & Peterson in Seattle specializing in real estate transactions, told a recent breakfast meeting of commercial real estate association NAIOP that financing conditions have steadily improved since last year.

“Our lending business has been rapidly expanding through this contraction, and I have seen, pretty much since the summer of 2012, that work has switched over from being restructurings and foreclosures to being more originating loans,” he said. “So it’s looking good.”

Jamie Farrar, managing director of Second City Capital Partners in Vancouver, shares Addicott’s outlook.

“Nobody views it as freefalling, where they did potentially 18 months, two years ago,” he said. “There’s a lot of optimism around leasing, deal prospects.”

Second City has invested $260 million in multi-family and office properties in second-tier markets across the southern U.S. It’s negotiating office lease deals with tenants aiming for 2014 occupancy, the kind of long-term planning that evinces confidence in economic conditions.

Similarly, in the coming weeks Second City hopes to close on 1,100 multi-family units in Austin, Texas. Farrar noted that financing has not been a concern.

“Access to financing for cash-flow type assets has been pretty easy for us; the CMBS market as well on the office side is incredibly strong for B-type product,” he said, noting that 10-year money can be had for 3.9%.

Bosa Development Corp. is also optimistic. Vice-president Richard Weir told NAIOP it has towers on the go in Seattle and San Francisco and a new 40-storey tower set to start in San Diego by the end of 2013.

Affordability lies east

RBC Economics’ latest survey of housing affordability across Canada highlighted a “directionless affordability trend” as the country ended 2012. While affordability showed the most significant movement – and improvement – in Vancouver, the city, “remains, by far, the least affordable market in Canada.”

Colliers International’s residential market report for the first quarter suggested that buyers will respond by looking east along the region’s transit lines.

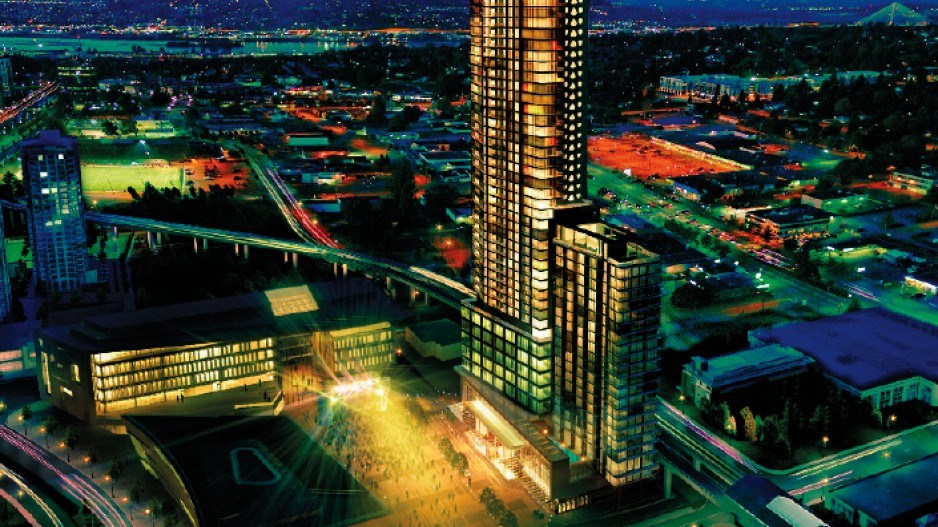

Projects in Burnaby and New Westminster have picked up on the demand, and Surrey is next in line with projects such as Century Group’s Three Civic Plaza.

“We always think buyers are gradually being pushed east,” said Scott Brown, senior vice-president, residential marketing and sales services for Western Canada with Colliers. “We think that’s going to cross over the Fraser – not necessarily every stop, but you’re definitely going to see it.” •