BC's battered biotech sector has been looking pretty sickly lately. Just when it looked like the sector was in recovery from recession, a number of local biotechs have suffered apparent relapses.

In February, Vancouver's QLT Inc. (TSX:QLT) went on a hiring spree, only to be ordered in July by a new board of directors – following a proxy battle – to reduce staff from 214 to 68.

And in March, Cardiome Pharma Corp. (TSX:COM) lost more than half its stock value in a single day when Merck & Co. Inc. (NYSE:MRK) announced that it was pulling out of an agreement to take Vernakalant, an oral version of the company's heart drug, through clinical trials.

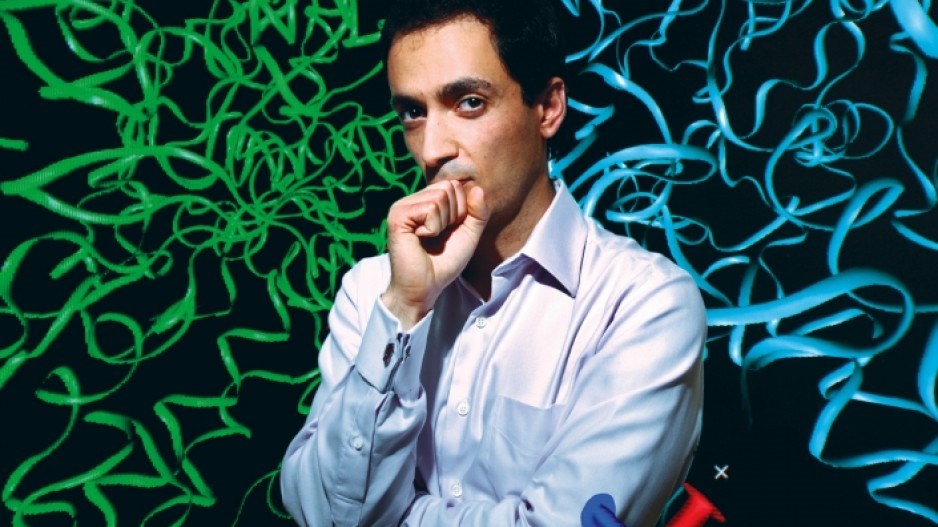

But all is not doom and gloom for the B.C. biotech sector, says Ali Tehrani, founder and CEO of Zymeworks Inc., which recently raised $11 million through the sale of common shares to a group of angel investors.

The Vancouver biotech has also received its first milestone payment from Merck under a $187 million collaboration agreement the two companies signed one year ago.

"The space that we're in – protein therapeutics – is very congested," Tehrani said. "To have validation from Big Pharma is huge. It gives us a huge momentum for signing more deals like this. Merck is still very active in this town, and the biotech sector is not as dead as people make it sound."

Zymeworks specializes in protein therapeutics and has six drugs in various stages of testing. Research on its main product – a cancer drug – is being funded by Merck.

Zymeworks distinguishes itself from other biotechs involved in protein therapies with its computational approach.

It uses a proprietary molecular modelling platform that allows it to eliminate a lot of dead ends before it begins "wet lab" testing on specific molecules.

The modelling saves a lot of grunt work and money.

But Tehrani said the company also has one other competitive advantage that has allowed it to thrive in the industry, despite a poor investment climate.

It has managed to stay "nimble and cash-conservative" – something investors look for.

"A company like ours, which started in Vancouver with just two people, has grown to 41 people, with a collaboration with a major pharma company and just raised $11 million," Tehrani said.

"It can't be that dead in town, and people can't be that disheartened by biotechnology."

Zymeworks isn't the only biotech that has managed to flourish by staying lean and focused. Aquinox Pharmaceuticals has raised $40 million in venture capital since forming in 2006 to help fund research for a new anti-inflammatory drug, AQX-1125, which is now in phase 2 clinical trials.

Aquinox founder and CEO,David Main – who has worked for both QLT and Inex Pharmceuticals (now Tekmira Pharmaceuticals Corp.) and chaired Life Sciences BC – said the sector has always been cyclical. The last seven years have been in a low investment cycle.

The cash drought has forced companies like Aquinox to become lean and focused.

"These days investors don't want to invest in large infrastructure," Main said.

"Because capital is harder to come by, investors are asking you to be more capital efficient, not putting your money into infrastructure but putting it into advancing the technology. Out of necessity, to attract capital, you need to be lean and mean and very focused."

Main said the poor investment climate has meant few new biotechs are being formed.

But he added that there are signs that venture capitalists and major pharmaceutical firms are again taking an interest in Canadian biotechs.

"Some of the pharmaceutical companies are putting money into new funds. There are even very large venture capital groups considering opening up in Canada.

"So I do see some optimism for new capital being able to create some new companies."