Scientists at Simon Fraser University say they might have discovered a way to turn off the HIV virus’ cloaking device – a discovery that could lead to a vaccine.

But getting a new drug or vaccine to market typically takes eight to 12 years and up to $1 billion – much of that related to human clinical trials.

Helping small biotechs and biopharmas accelerate their research and get to commercialization quicker is the aim of the new $50 million Life Sciences Innovation Fund announced last week by GlaxoSmithKline Inc., a Canadian pharmaceutical company.

“It’s more of a venture-style fund,” said Sav DiPasquale, GSK’s vice-president of business development, who was in Vancouver last week for the BioPartnering North America Conference. “We want to help accelerate these companies. Our $50 million I think has become a catalyst for more funds.”

GSK was one of the dozens of large pharmaceutical and biotech companies – including Bayer, Merck, Pfizer and Genentech – in Vancouver February 26-28 for the annual conference. GSK will be looking for three to five potential funding candidates.

“Let’s say a company needs $20 million,” DiPasquale said. “We may take half of that, or a quarter of that, but we would syndicate it with other venture capital companies.”

Not all scientists decide to spin out their discoveries into a company.

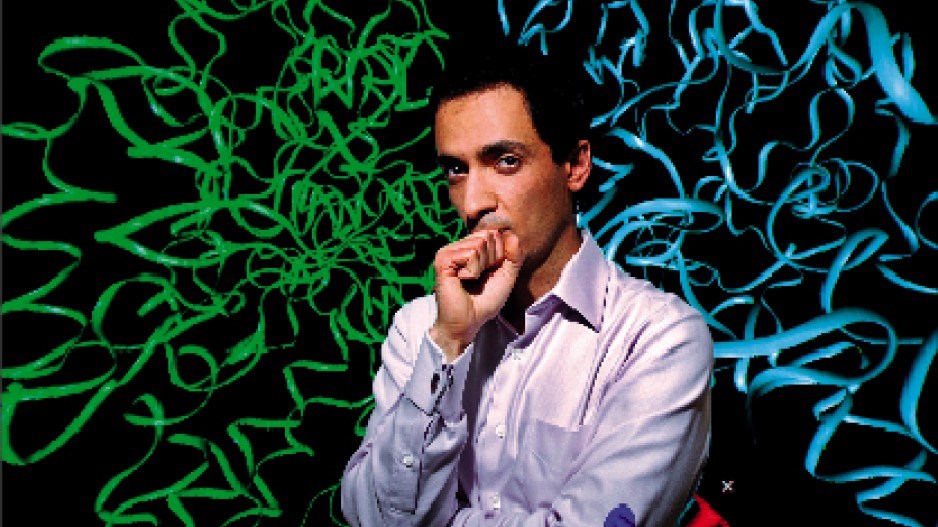

Ralph Pantophlet, assistant professor at SFU’s Faculty of Health Sciences, said that, if further studies prove the discovery his lab has made is likely to produce an HIV vaccine, they will likely seek a licensing deal with an existing company, rather than try to build a new one from the ground up.

Pantophlet and his team are still in the early stages of research. His lab and scientists in Italy jointly published their breakthrough in the February 24, 2012, issue of the journal Chemistry & Biology.

Pantophlet said he has already been contacted by two companies interested in a collaboration deal. Ali Tehrani, CEO of Zymeworks Inc., would not be surprised if the SFU discovery attracts partners right away.

“If you’re in a hot area like HIV, usually a lot will come to you,” Tehrani said.

Entrepreneurs who decide to build a company based on their discoveries have some daunting work ahead of them. Human drug trials cost hundreds of millions of dollars, and in the past some biopharma and biotech companies have found themselves growing at an unsustainable rate.

Faced with a sudden contraction of investment since 2008, the successful biotech and biopharma companies have learned to run leaner operations, Tehrani said.

“The CEOs are … learning that you don’t need to create a 1,000-man company or buy your own building. You can create companies that are sub-50 that are very cash efficient. The CEOs are hiring executives beneath them that have that mentality, and they know how to run a budget really tightly.”

Striking collaboration deals with large pharmaceutical companies is one way to leverage the money needed to sustain the company while it’s still in the research and development stage.

Zymeworks, which specializes in antibody-based therapeutics, struck such a deal with Merck last year that’s worth $187 million.

“That was a big inflection point,” said Tehrani, who was a guest panellist at last week’s BioPartnering conference.

The deal, according to LifeSciences BC president Donn Enns, was among the one $1 billion worth of partnership deals done in the last nine months between small local firms and large pharmas.

Tehrani explained how a small Vancouver biologics company was able to attract the attention of a pharmaceutical giant like Merck.

“Our business model is very simple,” he said. “You want to have strategic partnerships that basically pay for your R&D.”

Added Enns: “Partnering is becoming a strategic pillar in a company’s growth. Traditionally, companies would internalize their R&D efforts. That traditional model is changing to where there’s a shared risk.”

Tehrani said the local biotech and biopharma sectors are entering a period of growth. “There’s going to be a lot of good news in the life sciences sector in British Columbia, both from the academic sector and the industry sector.” •