Shaw Communications Inc. (TSX:SJR.B) (NYSE:SJR) is selling Shaw Media to Corus Entertainment Inc. (TSX:CJR.B) in a deal worth $2.65 billion, the companies announced January 13.

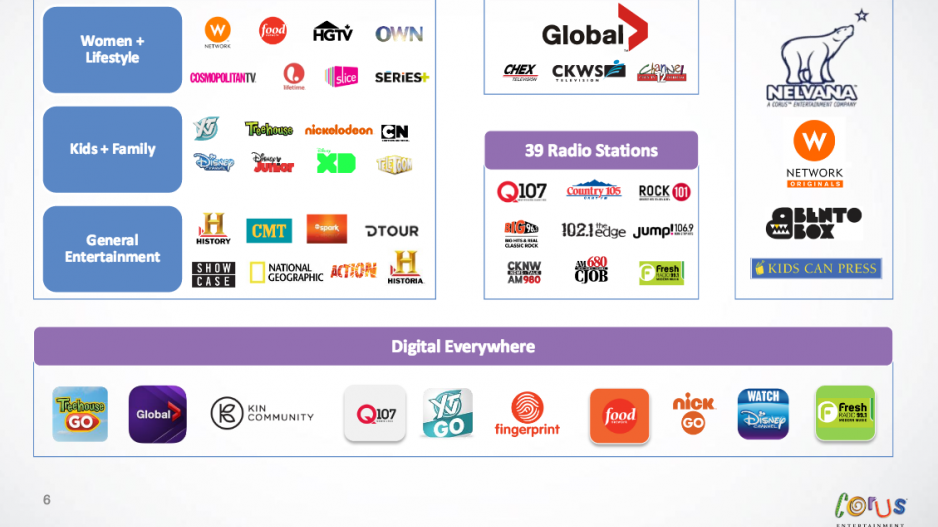

The transaction will see Corus acquire Shaw Media’s full suite of TV channels, which include its conventional network, Global television and 19 specialty channels including Food Network Canada, Showcase and HGTV Canada. Shaw will retain its interest in Shomi, its streaming-service partnership with Rogers Communications Inc. (TSX:RCI).

“This transaction represents a significant milestone for Shaw, firmly positioning the company as a leading pure-play connectivity provider with an attractive growth profile while allowing Shaw to participate in the significant upside potential resulting from the combination of Shaw Media and Corus,” said Shaw CEO Brad Shaw.

“With the previously announced acquisition of Wind [Mobile] and sale of Shaw Media, Shaw will be focused on delivering consumer and small business broadband communications.”

The sale price consists of $1.85 billion in cash and 71 million Corus shares at $11.21 per share, totaling $800 million.

Both companies are controlled by the Shaw family. After the deal is completed, Shaw Communications will own approximately 39% of Corus’ total issued equity.

Shaw Communications said it will use proceeds from this sale to Corus to fund its $1.6 billion purchase of Wind Mobile, which was announced in December. Both transactions are expected to close in the company’s third fiscal quarter.

The deal is subject to approval by the Canadian Radio-television and Telecommunications Commission (CRTC) and Corus shareholders. It is not subject to approval by Shaw shareholders.

As of press times, shares of Shaw Communications were trading at $25.13 per share, an increase of 6.7%. Corus Entertainment shares had dropped 6.8% to $10.92 per share.