With US$500 million at its disposal, the Global Health Sciences Venture Fund is the largest entity in Canada investing in life sciences firms.

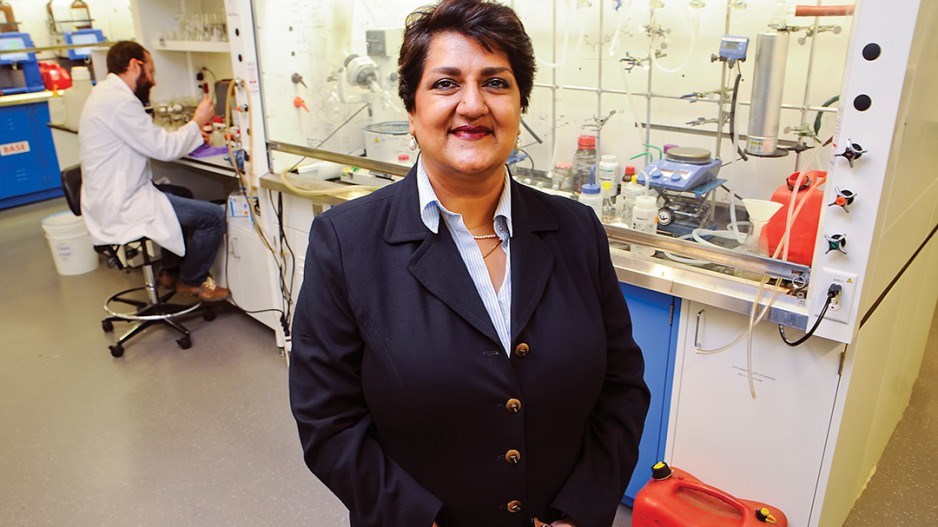

But Quark Venture CEO Karimah Es Sabar is quick to note this is a “transoceanic” fund intent on making its mark across the globe even if it calls Vancouver home.

The fund, backed by Quark Venture and Chinese investment bank GF Securities Ltd., has offices sprinkled across North America and Asia.

“For us it really doesn’t matter where we are parked, but I think for B.C. and Canada, it matters,” said Es Sabar, who previously served as CEO of the Centre for Drug Research and Development (CDRD) on the University Endowment Lands. “Where you have large pots of capital … you have better access to it because it’s at your doorstep.”

She said it’s likely more entrepreneurs in life sciences would be drawn to Vancouver knowing that such a large fund is based in the city.

Last year, the Global Heath Sciences Venture Fund announced a US$30 million investment in Burnaby-based antidepressant medication firm MSI Methylation Sciences Inc. And an undisclosed amount also went to CDRD spinoff company Sitka Biopharma, which specializes in bladder cancer treatments.

Five other investments have been made in companies or universities in the U.S.

“We’ve really spread our wings,” said Es Sabar, adding Quark is weighing investments in at least two more companies from Canada as well as one from Israel and one from France.

While Quark seeks to blaze a global trail, Lumira Capital is keeping its focus on B.C.

The Toronto-based venture capital firm is establishing its first West Coast office after receiving an undisclosed amount from the taxpayer-backed BC Tech Fund.

This $100 million fund of funds is required to invest solely in B.C. startups. So far, Lumira is the only company focused on life sciences to receive money from the tech fund.

“There has been a bit of a shortage of life science venture capital funds in the province, and being able to attract the calibre of this new fund to make investments in B.C. companies is a huge accomplishment for the tech fund and for the province itself,” Gerri Sinclair, managing director at Kensington Capital Partners’ Vancouver office, told Business in Vancouver earlier this month.

Toronto-based Kensington manages the BC Tech Fund and selected Lumira to manage a portion of it (Kensington Capital managing director Rick Nathan told BIV last year he expected investments in other funds to be less than $15 million).

Last year, Lumira made seven investments in the life sciences space totalling $124 million, according to Canadian Venture Capital and Private Equity Association data. Vancouver-based cancer drug treatment developer Zymeworks Inc. was among those investments.

Five other venture capital firms, none of which specialize in life sciences, invested more last year.

“We’ve been the most active investor in health in Canada bar none,” Lumira Capital CEO Peter van der Velden told BIV.

While holding its annual general meeting in Vancouver in early April, van der Velden said, his team spent a day meeting with 10 local firms.

“There are at least three companies in that [group] that we really like right now and we’re going to pursue.”