Vancouver drug developer Zymeworks could realize a US$908 million payout if all goes well with a GlaxoSmithKline (GSK) partnership the companies announced April 26 .

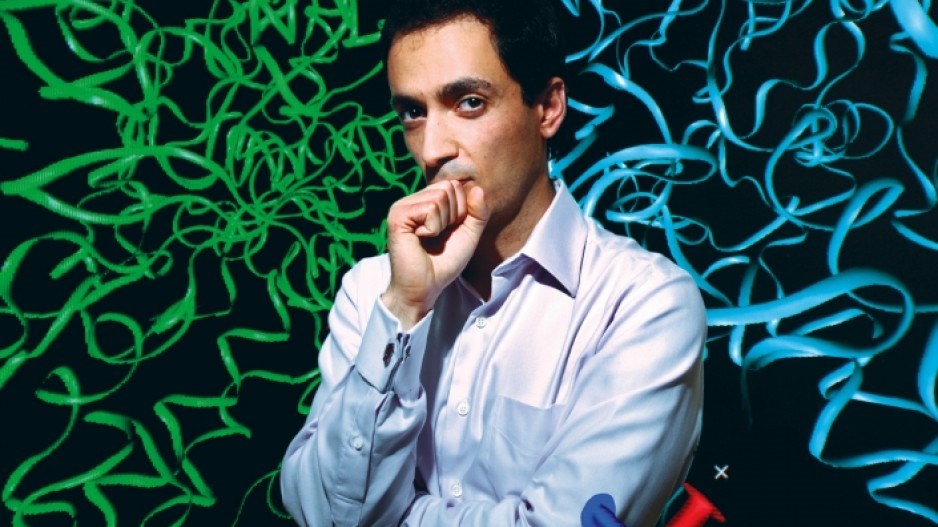

This pact is the most recent in a string of Zymeworks agreements that, combined, could yield more than US$4.4 billion if all goes well, company CEO, Ali Tehrani, told Business in Vancouver.

The GSK agreement gives the British pharmaceutical giant access to a Zymeworks drug platform that helps cure cancer.

Terms of the deal include GSK giving Zymeworks a US$36 million “near-term” payment, up to US$152 million depending on the success achieved in development and clinical milestones and up to US$720 million in payments if sales for future drugs flourish.

“We’re not working on any drugs for them,” Tehrani stressed. “They’re accessing a platform technology that we’ve developed and we are using to develop drugs ourselves. It is a lucrative deal for us because we can sit back and just collect our payments.”

He compared his company to an auto-parts manufacturer that makes engines. Those engines could go into motorcycles, lawnmowers, cars or other products.

GSK is developing its own drugs that would effectively use Zymeworks’ engine platform.

Zymeworks’ platform, called Azymetric, “turbocharges” antibodies in the human immune system and enables them to target the cells that need to be killed instead of what happens otherwise – blindly killing both healthy and cancerous cells, said Tehrani.

Surgery is usually the first treatment for people diagnosed with cancer. Chemotherapy and radiation then tend to be used to kill cells indiscriminately in the hope that the body will hit a reset button and return to health in the aftermath of the cell massacre.

Targeted therapy is another cancer treatment now sometimes used.

Zymeworks’ aim is to improve targeted therapy’s accuracy so that it can be used before, or instead of, chemotherapy and radiation, which have severe side effects, including hair loss.

Azymetric is one of four Zymeworks drug platforms.

GSK signed a separate agreement with Zymeworks in December that is also potentially worth many hundreds of millions of dollars. It would allow GSK to use Zymeworks’ Effector Function Enhancement and Control Technology (EFECT) platform to research, develop and commercialize certain drugs.

Zymeworks signed its first major deal in 2011, when it secured a contract with pharmaceutical giant Merck & Co. Inc. (NYSE:MRK) reportedly worth up to US$187 million.

In 2014, there were two major agreements with Eli Lilly and Co. (NYSE:LLY) that combined to be worth potentially more than US$375 million.

An agreement with Celgene (Nasdaq:CELG) was announced last year. Tehrani said it’s also potentially worth many hundreds of millions of dollars.

BDC Capital and Lumira Capital then co-led a US$61.5 million fundraising round in January.

His company has 90 employees working in the Broadway corridor and is hiring a range of new employees.

“Zymeworks’ success rein-forces that Vancouver is a biotech hub and that we are succeeding on the world stage,” said James Hatton, who is chairman of LifeSciences British Columbia and a biotechnology lawyer at Farris, Vaughan, Wills & Murphy LLP.

He said Zymeworks is in a top tier of B.C. life science companies that include the privately held Stemcell Technologies Inc. and Arbutus Biopharma Corp. (TSX:TKM), previously known as Tekmira Pharmaceuticals Corp.

Hatton added that privately held Kardium Inc. and Xenon Pharmaceuticals Inc. (Nasdaq:XENE) would also be in that top tier of successful companies. •