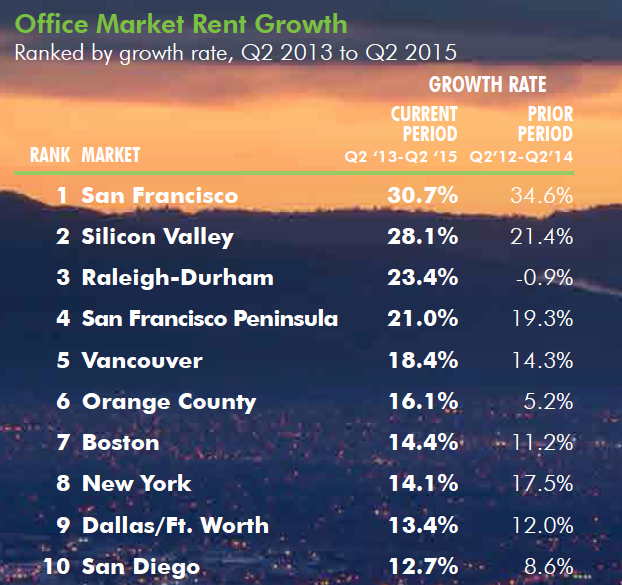

CBRE’s Tech Thirty 2015 survey of North American technology centres ranks Vancouver as one of five cities with the fastest office-rent increases.

Vancouver ranked fifth out of 30 cities studied with 18.4% rent growth between the second quarter of 2013 and the second quarter of 2015, according to the report.

That is less than Greater San Francisco (30.7%), Silicon Valley (28.1%), Raleigh-Durham (23.4%) and the San Francisco peninsula (21%).

Vancouver also ranked fifth during the two-year period that ended in mid-2014. In that period, for comparison, Vancouver office rents for technology companies jumped 14.3%.

(Source: U.S. Bureau of Labor Statistics, Statistics Canada and CBRE Research July 2015)

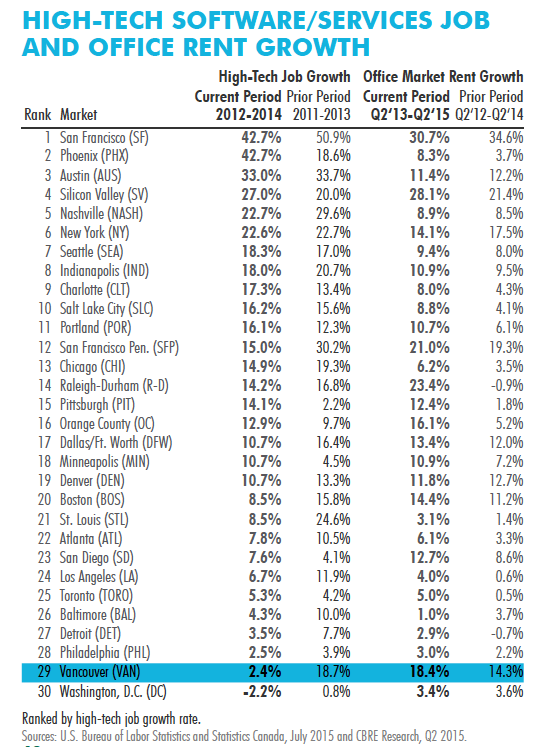

The study included data on job growth between 2012 and 2014 because newer job data is not available.

That data showed that Vancouver performed poorly – ranking No. 29 out of the 30 cities with 2.4% job growth. Vancouver had ranked 10th for job growth in the previous 2011 to 2013 time frame, the report noted.

The report noted that the biggest office-lease deals involving technology firms so far in 2015 in Vancouver are:

•Avigilon leasing 135,000 square feet at 555 Robson Street;

•Sony Pictures Imageworks leasing 75,000 square feet at Pacific Centre; and

•Animal Logic (Warner Brothers) leasing 47,000 square feet at 840 Cambie Street.

Multinational technology companies which plan to make the biggest office moves in Vancouver in 2015 inked their leases before the start of the year.

For example, Microsoft has leased 150,000 square feet at Pacific Centre and Amazon.com has leased 156,000 square feet at the Telus Garden development. Those companies' workers, however, have yet to occupy the space.

The CBRE report only included two Canadian cities.

Toronto ranked No. 24 for job growth and No. 24 for office-rent growth.

“The two Canadian Tech-Thirty office markets are at opposite ends of the spectrum,” the report noted. “Toronto is in the maturation stage and Vancouver is in the earlier, stabilization phase.”

The report calculated that, as of the middle of 2015, high-tech tenants represented 44% of current downtown Vancouver office space.

“The Yaletown and Gastown submarkets remain highly attractive to technology tenants looking for ‘stick and brick’ style premises,” the report said. “Low vacancy and rising rental rates in Yaletown and Gastown, however, are pushing technology tenants into neighbouring industrial areas, namely Mount Pleasant and Railtown.”