When Tesla Motors (Nasdaq:TSLA) founder Elon Musk unveiled his company’s line of home and office batteries in April, he said the Powerwall would create “a fundamental transformation of how the world works.”

Tesla’s wall-mounted lithium-ion battery taps into a solar power grid to generate and store power. The sun no longer has to be visible for solar panels to be useful – the Powerwall simply stores excess energy produced during the day.

But while Tesla is taking aim at mostly the consumer market, B.C. firms are pushing for solutions to the energy storage problem for commercial markets.

Vancouver startup ZincNyx Energy Solutions has been developing a zinc-based flow battery that uses fuel cells and containers filled with liquid electrolyte to store and release electricity originating from wind or solar generators.

“If you prove that your technology is going to work, you can write your ticket,” CEO Suresh Singh told Business in Vancouver.

The company was awarded $2.9 million in funding in March from the rigorous Sustainable Development Technology Canada program, which Singh said is helping validate the technology for potential investors.

Teck Resources (TSX:TCK.B), which is ZincNyx’s primary investor, will be deploying the first system this summer on a work site where energy isn’t always easy to come by.

Much like Musk, Singh expects the energy grid to soon change fundamentally after companies spent years focusing on solar energy solutions.

Because the price of solar has fallen so significantly, the ZincNyx CEO said companies are now trying to figure out how to store all the energy created from solar panels during the day.

“Solar is going to be the key,” Singh said. “I think, though, with the right partners, we’ve got something great here.”

He added high expectations created by Burnaby-based Ballard Power Systems (TSX:BLD) soured many investors’ views on energy storage solutions when the company stumbled, but even those attitudes are changing rapidly.

ZincNyx’s batteries were originally developed to serve as backup power systems for telecom sites. And Ballard has had success recently selling to wireless providers in India interested in low-to-zero-emission backup power systems for the country’s 300,000 telecom towers, which face frequent grid outages.

The company secured a contract during the first quarter to supply Reliance Jio Infocomm Ltd. with an initial order of 100 fuel-cell backup power systems. Ballard also made headway last quarter getting the same technology certified for the New York City Fire Department’s communications system.

“This is an underserved market in major metropolitan centres in the U.S., where diesel and battery options are not able to effectively compete,” CEO Randy MacEwen said in an April conference call with investors.

“This approval … now enables us to continue trial and commercial deployment discussions with potential U.S. telecom customers.”

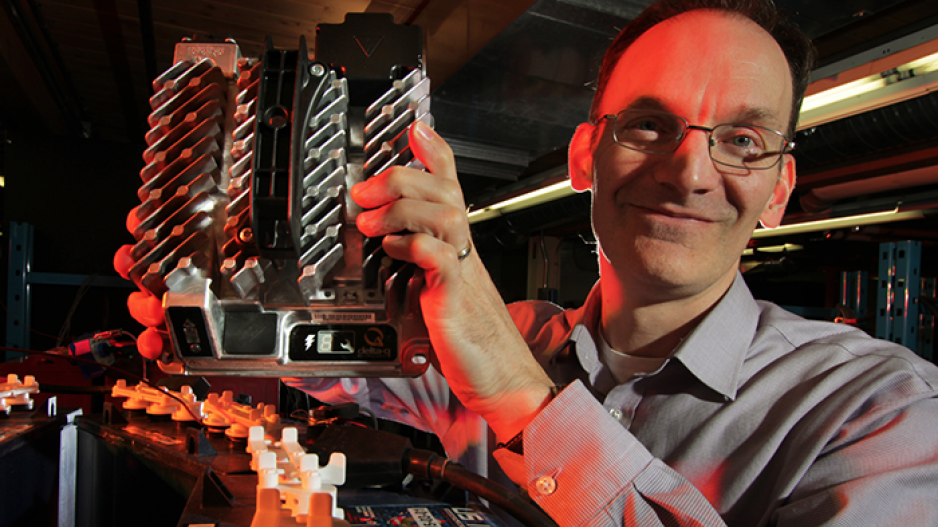

Photo: ZincNyx CEO Suresh Singh’s company is commercializing a zinc-based flow battery to store energy generated from renewable sources | Credit: Rich Lam

Dave Boroevich, chief marketing officer at Burnaby’s Alpha Technologies, said examples of this type of demand show how energy storage is becoming more relevant to large businesses.

“If you’re generating power and you’re not able to store it, then unless you can use it immediately it becomes wasted if you can’t feed it back into the grid,” he said.

Alpha Technologies partnered with Corvus Energy and researchers at the University of British Columbia in 2013 to develop a $5.1 million “smart grid” that would use lithium-ion batteries to store energy for peak hours, when the demand for, and cost of, energy is at its highest.

But Boroevich cautioned that the market for energy storage technology could be limited, at least on the West Coast.

“A lot [of customers] are looking at it and thinking about the long-term potential, but not many are actually investing in it because the cost of energy – particularly here in B.C. – is so cheap relative to the alternatives,” he said, adding the lack of sunny weather in B.C. makes investing in solar power grids less lucrative here as well.

“A lot of the new technologies are being driven by the electric-vehicle market – that’s where the big dollars are going to be.”

For example, Burnaby’s Delta-Q designs and produces chargers that connect to power grids and feed electric vehicles like golf carts and lift trucks.

As zero-to-low-emission vehicles have become more efficient and maintenance costs have dropped dramatically, CEO Ken Fielding said Delta-Q’s reach has grown considerably after the company launched its first product in 2003.

“About 80% of that industry back 20 years ago was gas-powered [golf] cars,” Fielding said. “That’s now shifted. We now think 80% to 85% of the market is electric.”

Meanwhile, Musk said the Powerwall would also capitalize on one of the markets just opening up for Delta-Q: developing nations.

For both Tesla and Ballard, providing energy storage devices to developing countries means those customers are no longer beholden to expensive and lacklustre infrastructure. For Delta-Q, it means servicing the same clients who need cheaper alternatives.

“We’re seeing these small, purpose-built vehicles that can move people around really exploding around the world, and we’re dealing with a number of OEMs [original equipment manufacturers] that serve that market,” Fielding said.

Whether it’s telecom backup power systems, off-grid systems for remote mining operations or electric vehicles, Singh said he doesn’t see demand drying up for energy storage solutions.

“It’s a worldwide market. It’s not going away.”