Apartment sales even

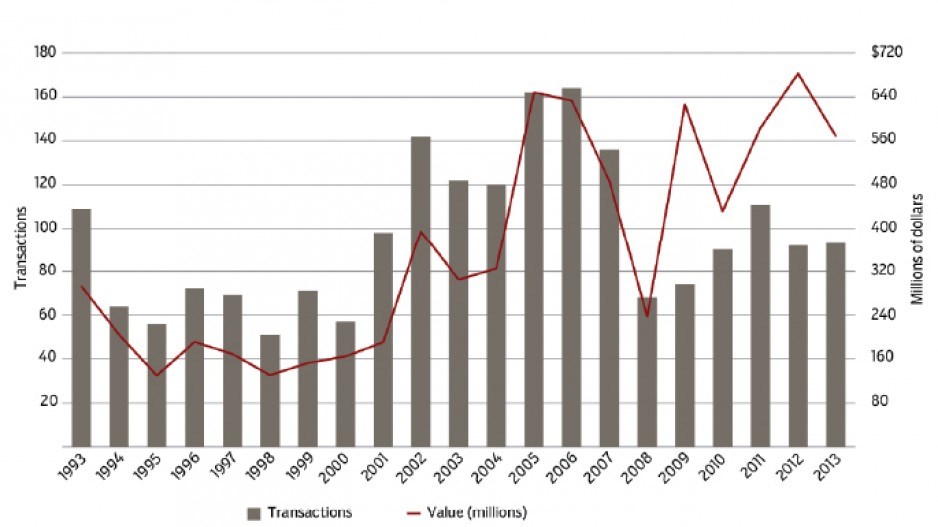

Preliminary figures from apartment mavens David and Mark Goodman indicate that 2013 was on par with 2012 so far as sales activity goes.

The year saw 93 sales, just one more than the 92 properties sold in 2012.

But whereas the distribution of deals in 2012 was almost evenly split between Vancouver proper and the rest of the region, investors concentrated on Vancouver in 2013, with a total of 54 deals here versus 39 in the suburbs.

“Investors appeared to focus on location, stepping up their acquisition of core, Vancouver-based multi-family buildings while simultaneously curtailing their investment in suburban areas,” David Goodman said.

Vancouver offers what many suburban locations can’t: several properties with lower vacancies, an older stock with better potential for repositioning in evolving neighbourhoods and access to transit connections that shorten commute times to points throughout the region.

Goodman noted that investors were willing to pay approximately 15% more per suite to secure desirable properties in 2013.

This occurred even as aggregate investment volumes dropped from $682.7 million in 2012 to approximately $569.1 million last year, thanks largely to a drop-off in suburban transactions.

Yet with a modest increase in investment in Vancouver properties versus the significant share of transactions the city claimed, Goodman noted that prices here show signs of maxing out.

“Vancouver, for the first time in 10, 12 years, is actually showing a plateauing,” he said, “and that, to me, is very important.”

Nevertheless, demand for new, well-located rental properties is set to remain steady in 2014, all things being equal.

With five deals booked for this year and a sixth in the works, the Goodmans are optimistic that investors will continue to be placing dollars in Vancouver.

Solid assessment

With assessment notices in hand and year-end sales data assembled, homeowners have a picture of stable conditions in the Lower Mainland’s residential property market.

Despite fluctuations through 2013, including a rebound in sales in the year’s latter half, the benchmark residential price in the region in December 2013 was $540,900, a modest 1.6% rise over December 2012.

The gain was thanks largely to a 2.1% rise in the benchmark price in the Real Estate Board of Greater Vancouver’s area.

This countered a downturn in prices in sales tracked by the Fraser Valley Real Estate Board.

The benchmark price in the Fraser Valley rose 1.85% in 2013’s first half but reversed almost as much in the second half, dropping 1.5% – emerging just a third of a percentage point higher at the end of 2013 than a year earlier.

A glance at BC Assessment Authority data presents a slightly different picture.

Pegged to July 1, values for assessment purposes provide a mid-year read of a market that may change dramatically in the succeeding months.

For example, the aggregate value of Lower Mainland residential properties increased by a single percentage point over July 1, 2012; real estate board data, by contrast, indicates that the prices homeowners could expect at sale slid backwards during the same period.

But by the time the assessment notices arrived in the first week of January, resale prices in the Lower Mainland had inched ahead of the gains on which assessed values were based.

Start your engines

The boom in office construction in Vancouver is poised to rise another decibel as Yuanheng Holdings Ltd. proceeds with plans for the site it acquired at 1395 West Broadway at Hemlock Street in spring 2012.

Condo marketer Bob Rennie remarked to the Urban Development Institute at the time that the $30 million paid for the site was in line with long-term development plans – and in no way related to condo development.

The home of a Mercedes-Benz dealership – which will move to 550 Terminal Avenue next week – the site continues to be an important commercial property that benefits from being within the Broadway corridor as well as near Granville Street with its direct route to downtown and points south.

“The reason a site like Mercedes-Benz sold well over the $24 million that the locals would pay is simple,” Rennie said two years ago. “The mainland China buyers saw a long-term hold and the commercial value, beyond the instant condo development gratification that I like.”

Gratification is now a bit closer as Mercedes-Benz moves out.

Yuanheng intends to develop 200,000 square feet of office and retail space on the site. •